Monday Morning Huddle

20 March 2023

CME Spot Cheese Stages Comeback, Despite Discounted Upper Midwest Milk:

Spot cheese markets continued to rally this week, with Cheddar barrels UP 19 cents from Friday to Friday, with 36 loads traded as a large-end user continues to accumulate inventory. The barrel market has increased 43 cents since March 2nd when it set its 2023 low of $1.53/lb. Friday’s price was the highest since November 6th, 2022. The block premium to barrel increased slightly this week to 3.75 cents, but it is still significantly lower than the first nine weeks of 2023 when it averaged over 32 cents. Block prices increased, adding 21.75 cents from the previous Friday, on smaller volumes. Fundamentally, supply and demand data do not support current prices, and the recent market strength will likely be short-lived. Weekly average prices of CME spot butter, whey, and nonfat dry milk (NDM) all moved higher, though fundamentals suggest more corrective action rather than a than a change in the longer downtrend.

Wild Weather, But Milk Supplies Maintained:

Flooding occurred throughout California last week, causing fields and roadways to be covered in water, with primary and alternative routes closed throughout the state, delaying transportation and causing plant downtime. Governor Newsom designated 40 of 58 counties in California as disaster counties, including Tulare, Fresno, Kings, Madero, Mariposa, and Merced. While it is unclear how quickly the Central Valley will dry out and the impacts on this year’s crops, the water was much needed and helped replenish major reservoirs. Dairy Market News (DMN) reported that milk supplies were steady, despite the heavy rains, and up vs. January. A Nor’easter dropped three feet of snow on parts of New England last week, which caused delayed milk pickups, according to DMN. However, USDA commented that production is steady in other parts of the Eastern seaboard. Spot milk prices in the upper Midwest remain $4-$12/cwt. below Class III, indicative of ample volumes and possibly plants running at less than capacity.

Flashback to 2008?

Troubles in the domestic and international banking sectors have many people on edge that the economy is on the precipice of another 2008 financial crisis. Silicon Valley Bank’s and Signature Bank’s failed on March 10th and March 12th and on Wednesday, Credit Suisse’s biggest shareholder refused to inject more capital into the bank, causing its shares to fall 30%. Initially, Swiss National Bank offered to lend the bank $54 billion, which Credit Suisse snapped up. Over the weekend, though, UBS agreed to purchase the lender for $3.23 billion in a deal orchestrated by Swiss regulators to calm global markets. The Federal Reserve meets this Tuesday, with analysts expecting either no change in rates or a 25 basis point increase rather than the ½ point increase anticipated before the bank sector tension.

Busy Report Week Ahead:

The week starts off with a bang as USDA will publish the Feb ’22 US Milk Production Report this afternoon, with HighGround estimating a 1.3% increase vs. prior year. In addition, the market will be absorbing a Global Dairy Trade auction (Tuesday), data from China (Feb ’22 imports) and Europe (both dairy production & trade) as well as US ending stock data for cheese and butter (via USDA Cold Storage) on Thursday.

Last Week’s Reports & Analysis

HighGround’s US Dairy Commodity Price Forecast

CME spot cheese prices during the first part of January held above $2.00/lb, while markets gave way to fundamentals (stronger milk output, weaker demand) in Feb…Full Report

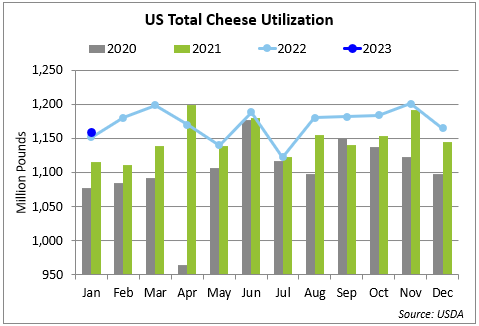

January 2023 US Dairy Supply and Utilization

Total cheese utilization eked above prior year levels driven by nearly flat year-over-year domestic demand while exports made up the bulk of growth climbing to an all-time high for the month of January… Full Report

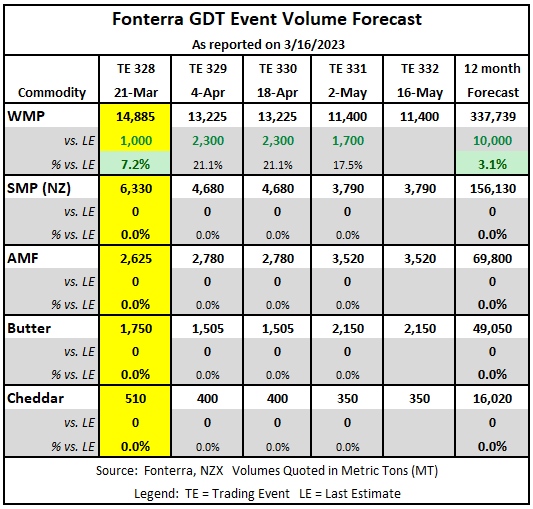

Pre-GDT Forecast Volume Analysis

Fonterra has posted their FY23 Interim Results, publishing a profit after tax figure of NZ$546 million, up 50% year over year or NZ$182 million, along with an earnings figure of 33 cents per share for its farmer shareholders and unit holders. Fonterra also upgraded its earnings guidance adding 5 cents per share to their forecast range which now sits …Full Report

Reports This Week

- Feb ’23 US Milk Production – Monday, March 20

- Jan ’23 EU-27 + UK Trade Data Report – Monday, March 20

- Global Dairy Trade 2nd March Auction – Tuesday, March 21

- Feb ’23 New Zealand Trade Data Report – Tuesday, March 21

- Apr ’23 USDA Advanced Prices & Pricing Factors – Wednesday, March 22

- Weekly EU Dairy Commodity Prices – Wednesday, March 22

- Weekly National Dairy Products Sales Report (NDPSR) – Wednesday, March 22

- USDA Dairy Market News Weekly Midpoint Prices – Thursday, March 23

- USDA Weekly Dairy Cow Slaughter – Thursday, March 23

- Feb ’23 US Cold Storage Report – Thursday, March 23