This calendar year, under a fresh US presidency, has begun on uncertain ground. While US farmers face mounting concerns over losing international market share amid escalating tariff threats—with China as well as new tariffs on Mexico and Canada set to take effect on March 4—New Zealand dairy farms have experienced a surge in confidence, reaching levels not seen in a decade. It is almost as if these two issues are two sides of the same coin.

New Zealand is enjoying an exceptional milk production season paired with record-high milk prices. For months, strong demand from China has played a critical role in absorbing the surplus milk solids from New Zealand, reinforcing the country’s position as a key supplier in the global dairy market.

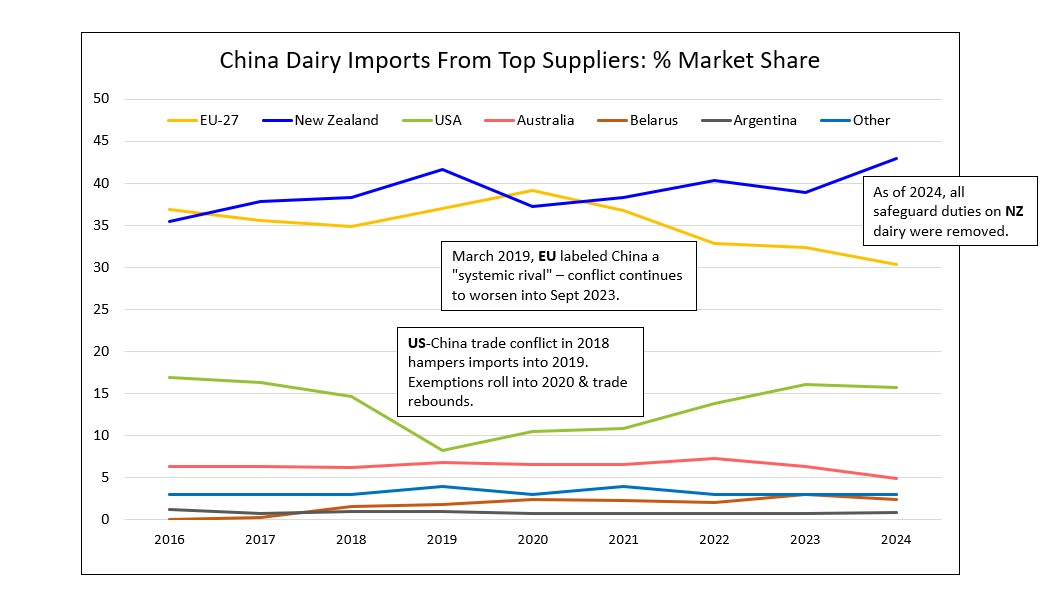

A closer look at recent political events reveals how global dynamics are reshaping dairy’s market share in China. In March 2019, when the EU labeled China a “systemic rival,” the EU’s market share within China began a steady decline—a trend that only intensified as conflicts worsened in subsequent years. Meanwhile, the US market share saw an aggressive drop in 2018/2019 but managed to regain some momentum between 2020 and 2023 after tensions eased slightly following the Phase One Trade Deal. In all of this chaos, New Zealand has managed to gain market share, aided in part by the NZ–China Free Trade Agreement.

Now, in 2025, the global dairy market is once again facing challenges from escalating US–China trade tensions alongside China’s long-term, though recently accelerated, drive toward domestic self-sufficiency. It is important to note that China’s efforts to bolster its domestic dairy production are not entirely new—they have deep roots. However, in response to external pressures including the first US trade war in 2018, these initiatives have taken off in recent history. It was not the best timing for China as dairy consumption faltered and domestic production became overwhelming, only for the industry to consolidate back to 2021 milk production levels before volumes exploded in 2022 and 2023. The friction in US–China relations is influencing how China sources its dairy imports, just as the market observed during the previous trade conflict. Facing ongoing external pressures, China is expected to continue diversifying its supply base.

Though if New Zealand’s export figures are any indication of what to expect from China’s upcoming January/February trade data, then the strong demand for New Zealand dairy products is clear. The HighGround team anticipates that short-term volatility will persist—exacerbated by regulatory shifts such as the upcoming expiration of import exemptions on whey for feed use from the US, which is already contributing to a futures sell-off.

Adding to the complexity, President Trump’s administration is sketching out tougher versions of US semiconductor import curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new President plans to expand efforts that began under Joe Biden to limit Beijing’s technological prowess (source). This persistence of a hardline approach only deepens the geopolitical rift.

The latest headlines from the Chinese government indicate that Beijing is once again actively enforcing measures designed to secure the nation’s food supply. Meanwhile, beneath these trade tensions lies an equally critical domestic issue for China—a looming population crisis. Reuters has reported that China’s population has fallen for the third consecutive year and in response, proposals to boost the birthrate are emerging. For instance, a Chinese adviser has suggested lowering the legal marriage age to 18 to encourage higher fertility. These demographic challenges could have long-term implications for domestic consumption and overall economic stability, adding another layer of uncertainty to China’s trade and food security policies.

Source: Trade Data Monitor