As the world rests in uncertain economic times, filled with mixed signals – from positive spending on travel and rising consumer confidence to record high credit card debt – there is a warranted concern regarding consumer spending into the end of the year as the Biden administration’s pause on federal student loan repayments will end in late August after being in effect for over three years (the student loan moratorium has suspended monthly payments and interest for most federal student loan borrowers since March 2020). Starting from March 2020, interest rates on all federally held government student loans have been set at 0%. However, beginning on August 29, interest will resume accruing. Of course the primary concern is that it can indirectly influence consumer spending patterns, including purchases of dairy products, from individuals burdened with debt. Here’s how it could potentially affect the US economy:

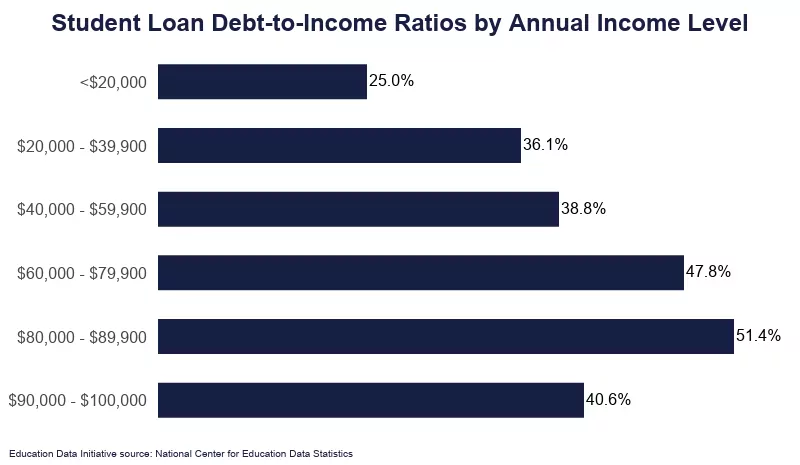

- Budget Constraints: a significant portion of individuals with high student loan debt may be allocating a significant portion of their income to debt repayment, limiting their discretionary spending capacity. This could potentially reduce their ability to spend on non-essential items, which could include certain dairy products.

- Prioritization of Basic Needs: Individuals burdened with debt may prioritize essential expenses such as housing, utilities, and groceries over discretionary purchases. In such cases, they may be more likely to allocate their limited funds towards basic food items rather than higher-priced or luxury products.

- Lifestyle Changes: Some individuals with high debt levels may adopt frugal or cost-conscious lifestyles in order to manage their financial obligations. This could include reducing overall spending, including on certain food items, or opting for more affordable alternatives and trading down.

- Market Competition: Reduced consumer spending power resulting from high debt levels may lead to changes in demand and purchasing patterns. This can influence the strategies of businesses, including those in the dairy industry, to adjust their pricing, product offerings, or marketing strategies to accommodate the evolving consumer behavior. Shrinkflation is a primary example, which is already impacting overall consumption rates of dairy.

- Household Formation and Housing Market: The burden of student loan debt can delay or deter individuals from starting families or purchasing homes. High debt loads can make it challenging for individuals to save for down payments or qualify for mortgages, potentially impacting the housing market and related industries.

- Financial Stability: High debt burdens can increase the risk of default and delinquency, leading to negative consequences for borrowers’ credit profiles. Financial instability at the individual level can have broader ripple effects on the economy, including reduced access to credit, decreased consumer confidence, and potential strains on the financial system.

–

The student debt repayment coincides with a higher inflationary atmosphere. Consumers have become more cautious and value-driven but they are still spending for now. One important observation is the unequal impact of inflation on different income classes in the US. There are certainly cracks in the existing data that has been hinting at a recession: strong consumer confidence, higher durable goods orders, an impressive jobs reports and new home sales. On the other side, inflation is still high, initial jobless claims have started to tick higher for three weeks and when adjusted for inflation, retail sales in May were actually down. Spending habits into Q4 should remain on the dairy industry’s radar given the uncertainty that weighs the US economy.