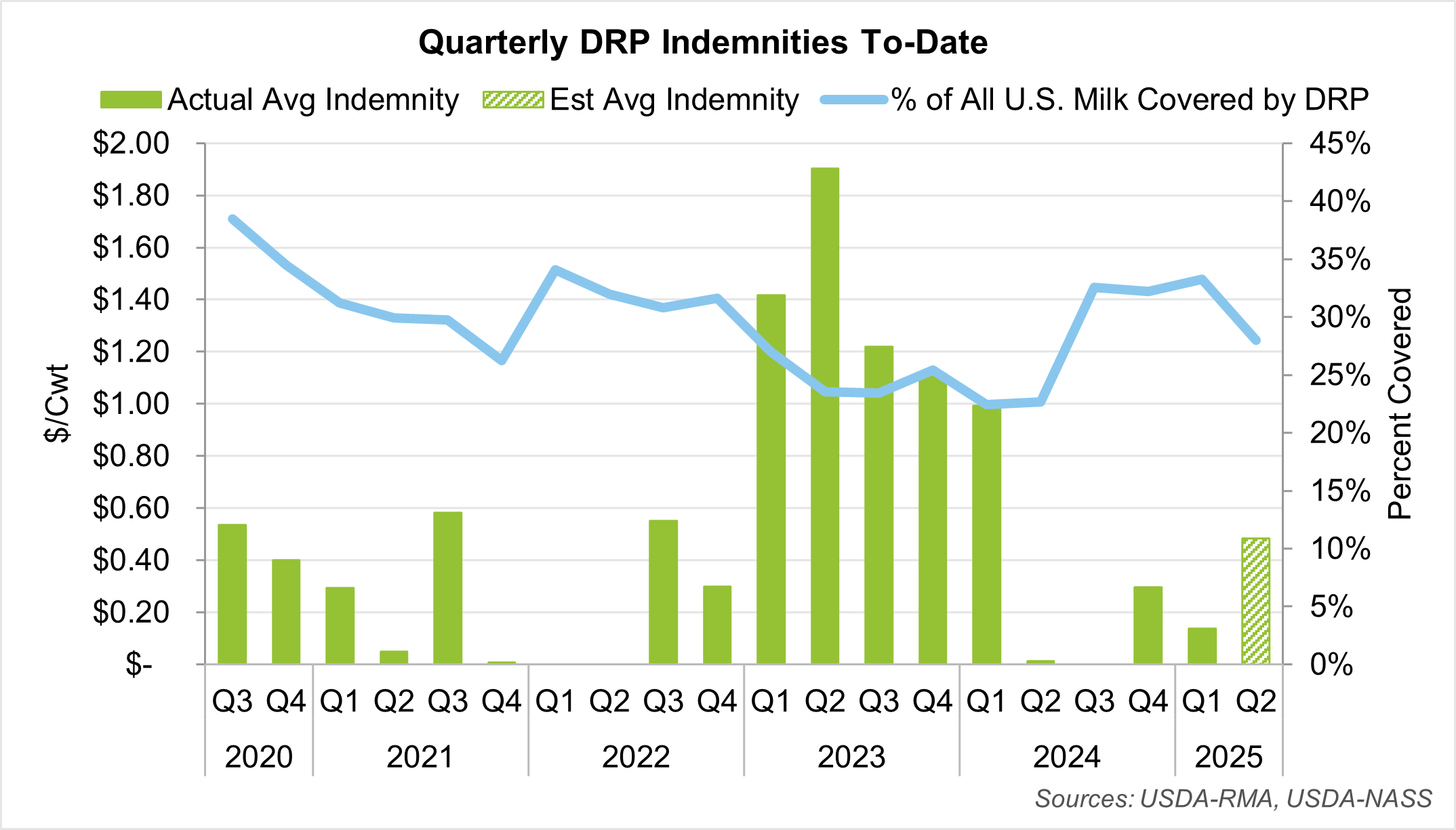

At the time of publishing, Q2 2025 indemnities have not yet been released by USDA-RMA. As such, the most recent quarter’s indemnity payments in this report are estimated using announced class and component prices and milk yields.

Overview & Key Points

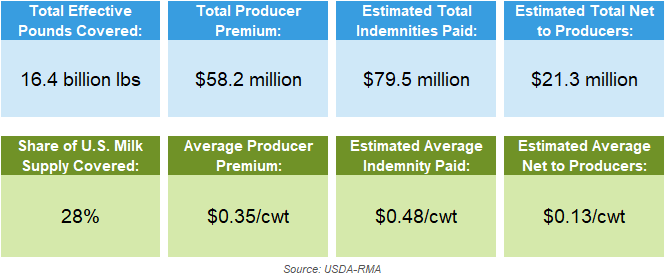

- Estimated indemnities for Q2 2025 averaged $0.48/cwt. After factoring in producer premiums, which averaged $0.35/cwt, the estimated net return to producers was +$0.13/cwt.

- Over 16.4 billion pounds of milk were covered under DRP during Q2 2025, representing 28% of the U.S. milk supply. While indemnity payments increased from the previous quarter, total covered milk volumes fell by almost 13% (-2.4 billion pounds).

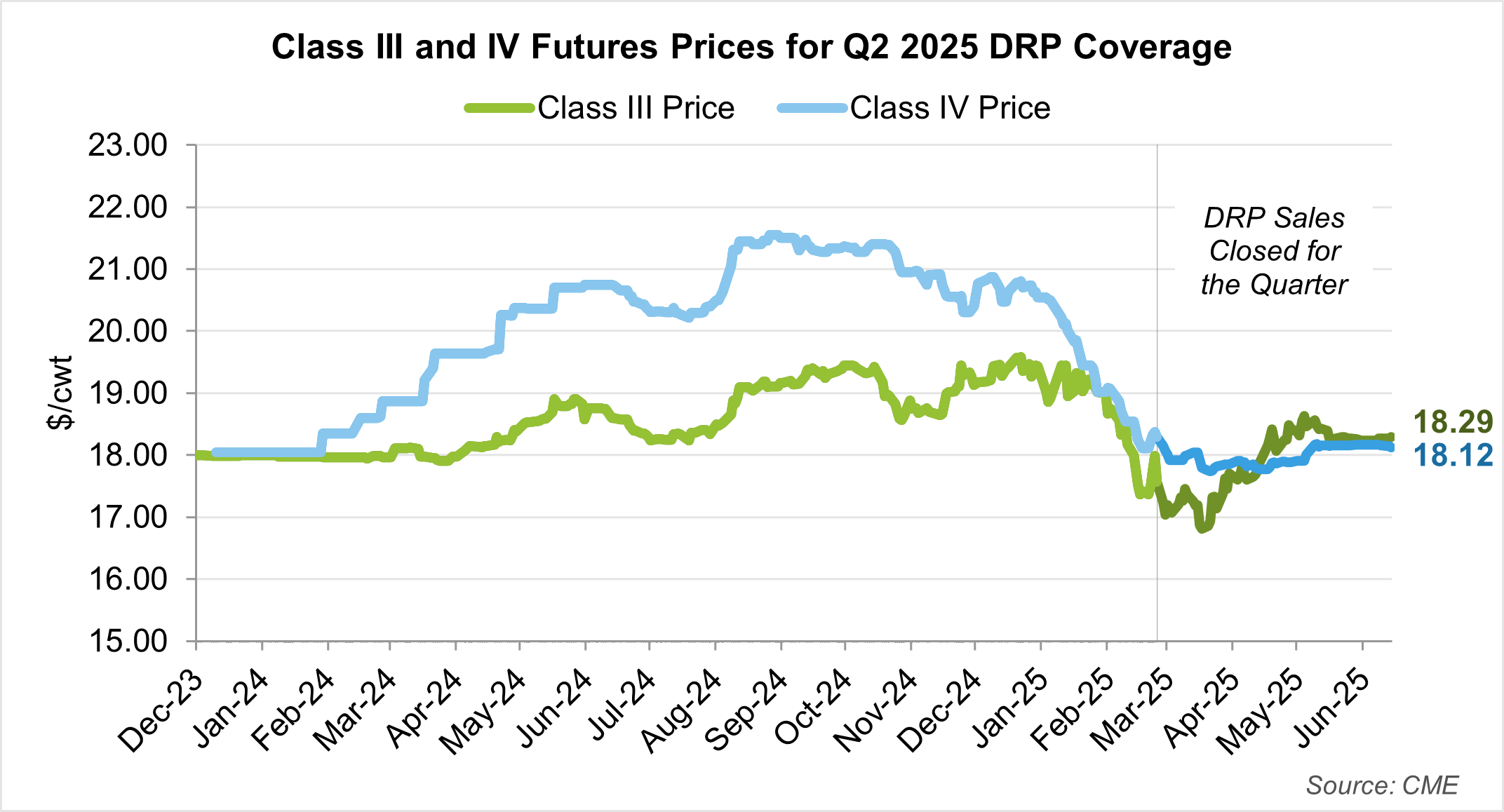

- If ignoring yield adjustment factors (YAF), indemnities for Q2 2025 would have triggered for both Class III and Class IV class pricing endorsements. Out of the 265 days that coverage was available, Class III coverage at the 95% coverage level exceeded the final settlement on 42 days (15.8% of the time), while Class IV coverage exceeded the final settlement on 186 days (70.2% of the time).

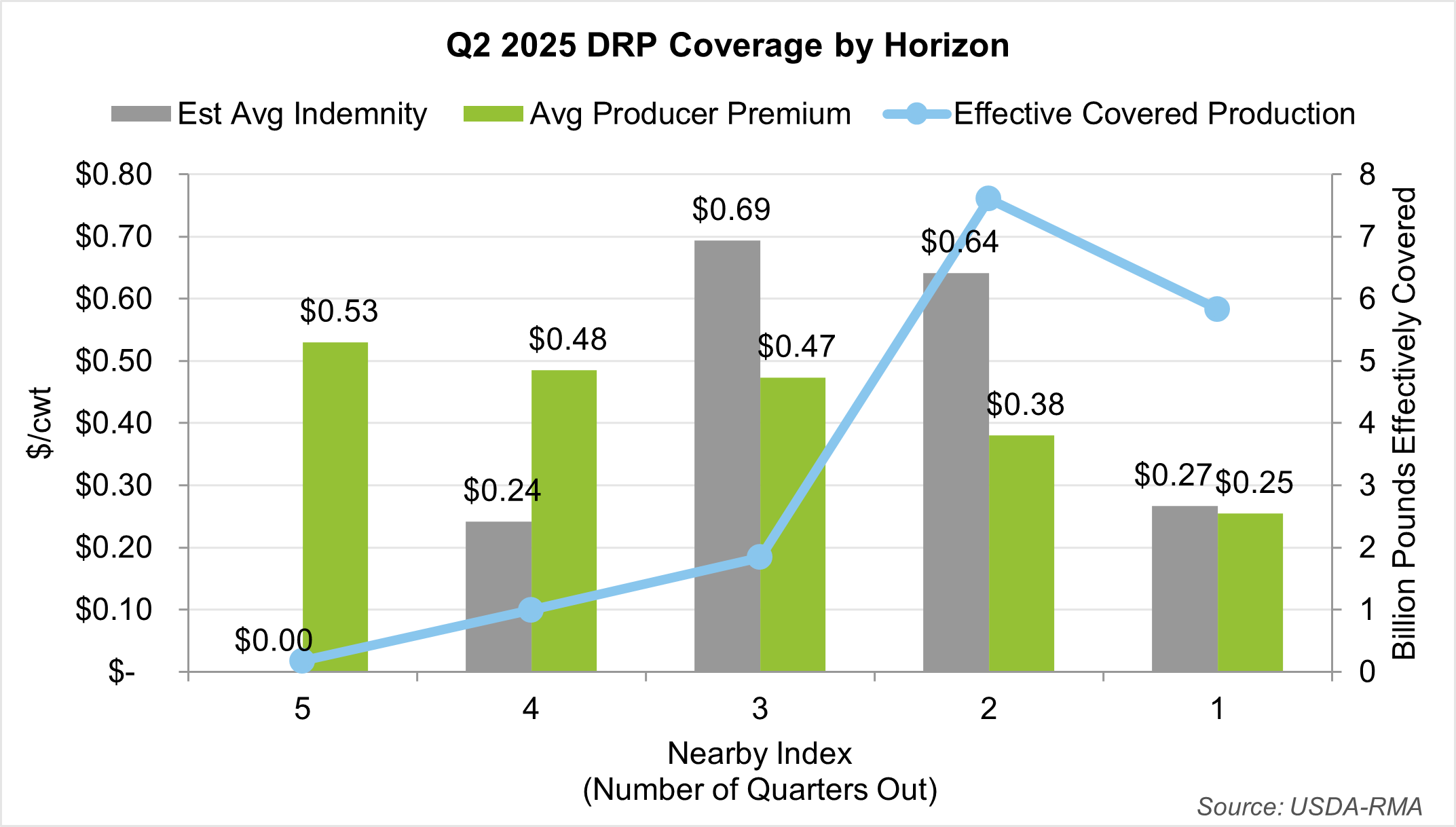

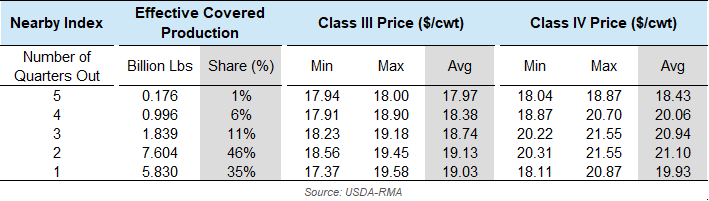

Coverage Performance by Horizon

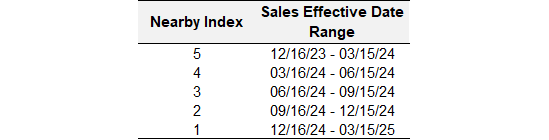

Note: Class IV coverage was not offered for Q2 2025 until December 28, 2023 (a few days into nearby index 5).

Participation and Performance

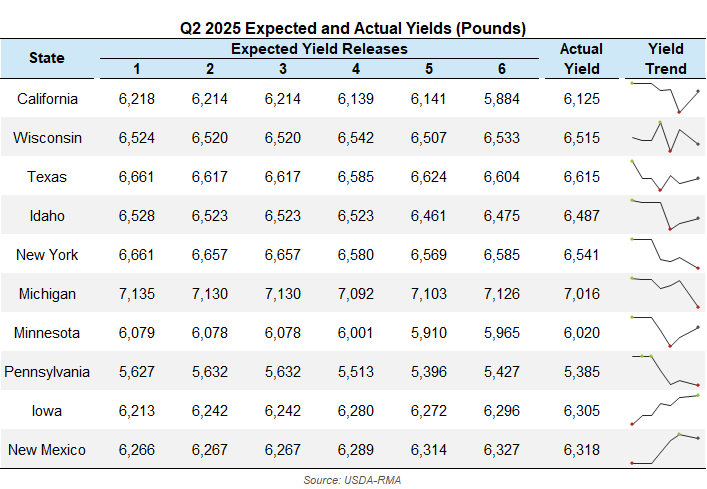

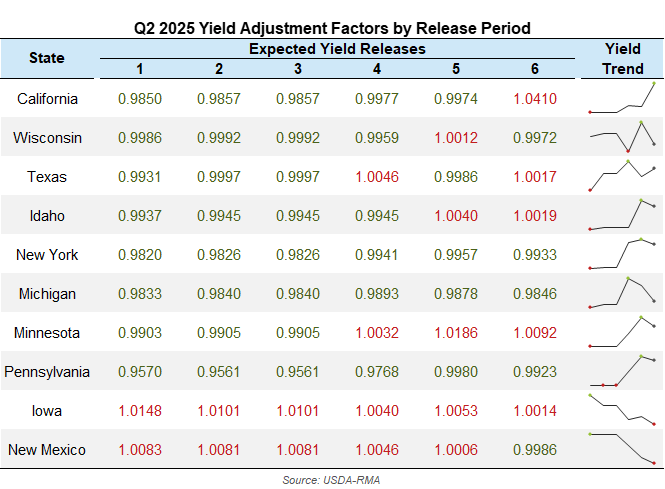

Impact of Yield Adjustments

The Yield Adjustment Factor (YAF) is calculated as the state or pooled production region’s actual yield released in USDA’s Milk Production report divided by the expected yield at the time of coverage. The YAF can have a positive or negative impact on indemnity payments:

- YAF > 1: When the actual yield is greater than the expected yield, the potential indemnity is reduced.

- YAF < 1: When the actual yield is less than the expected yield, the potential indemnity is enhanced.

Net to producers is equal to the indemnity paid minus the producer premium. Effective covered milk production is equal to the declared production times the protection factor. Class III versus IV coverage is calculated as the effective covered milk production times the class price weighting factor or the component price weighting factor.

Disclaimer: HighGround Insurance Group (HGIG) is an agency affiliated with HighGround Dairy (HGD). HGIG is a licensed insurance agency in many US states. HighGround Dairy is a division of HighGround Trading (HGT), an Introducing Broker (IB) registered under United States Laws. Nothing contained herein shall be construed as a recommendation to buy or sell commodity futures or options on futures. This communication is intended for the sole use of the intended recipient. Futures and options trading involves substantial risk and is not suitable for all investors.