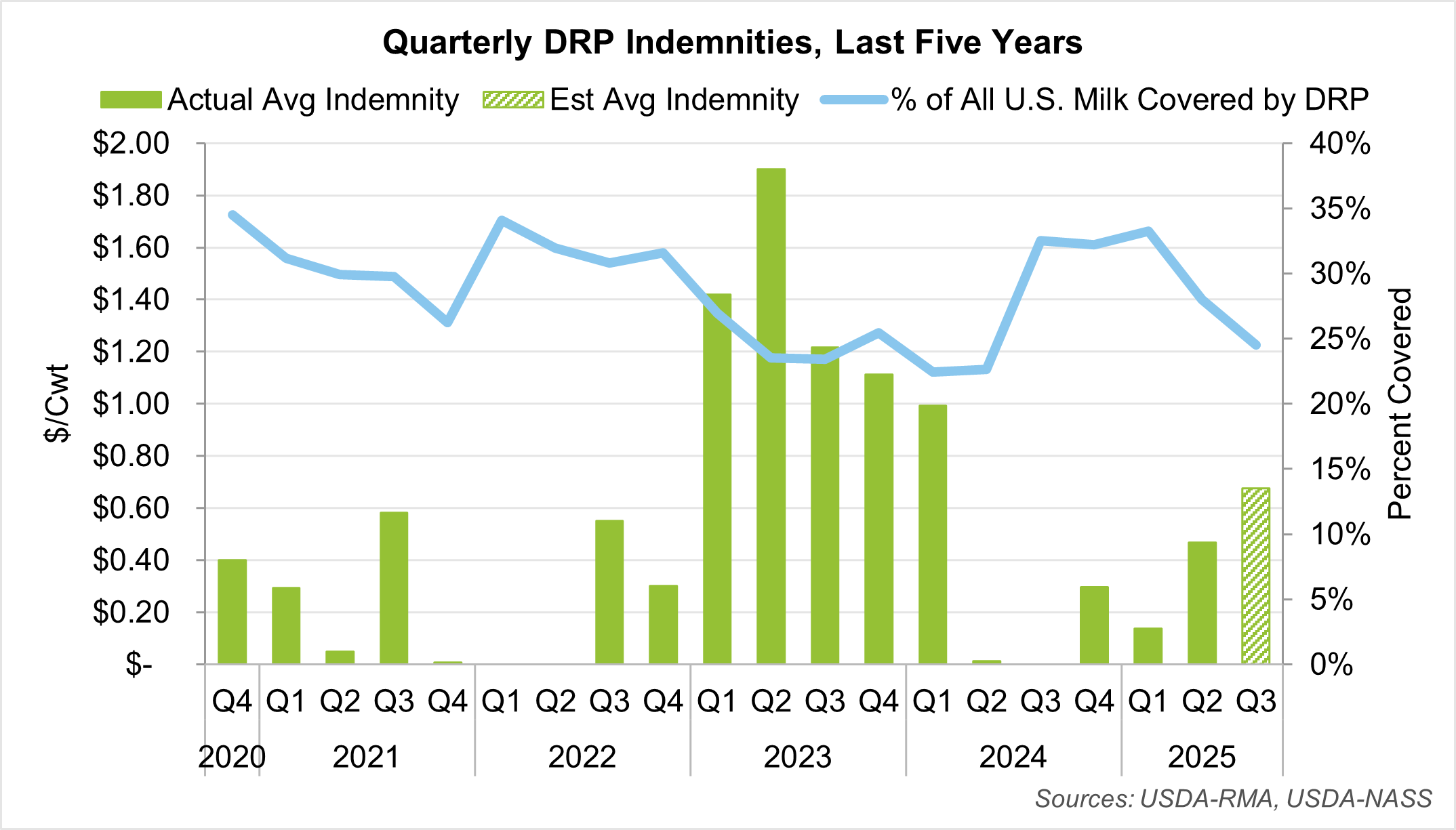

At the time of publishing, Q3 2025 indemnities had not yet been released by USDA-RMA. As such, the most recent quarter’s indemnity payments in this report are estimated using announced class and component prices and milk yields.

Overview & Key Points

-

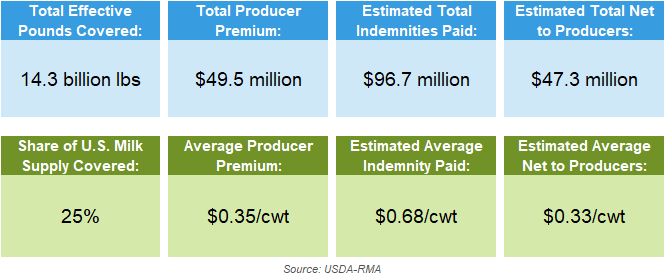

Estimated indemnities for Q3 2025 averaged $0.68/cwt. After factoring in producer premiums, which averaged $0.35/cwt, the estimated net return to producers was +$0.33/cwt.

-

Just under 14.3 billion pounds of milk were covered under DRP during Q3 2025, representing 25% of the US milk supply. While indemnity payments increased from the previous quarter, total covered milk volumes fell by over 13% (-2.2 billion pounds).

-

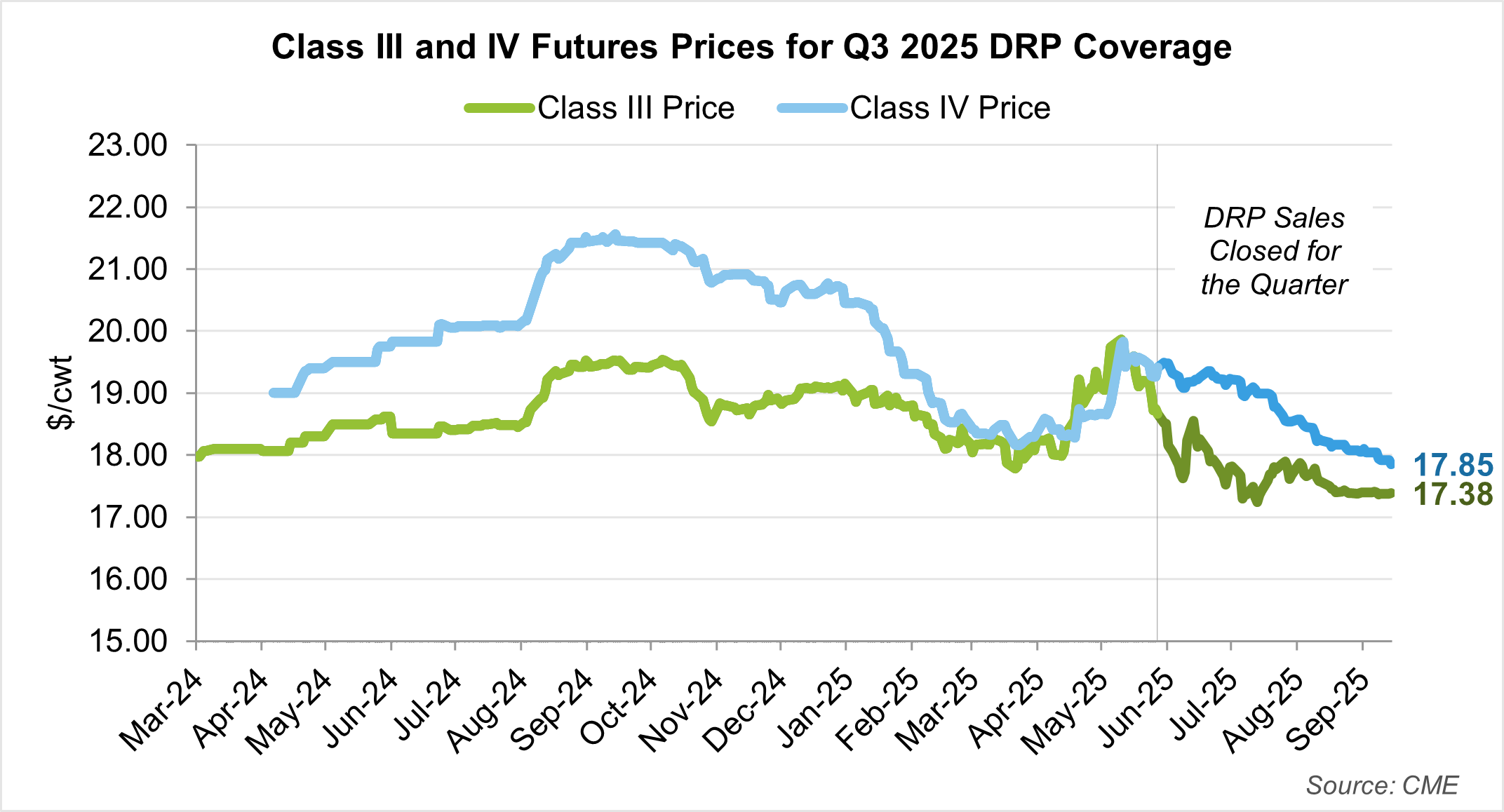

If ignoring yield adjustment factors (YAF), indemnities for Q3 2025 would have triggered for both Class III and Class IV class pricing endorsements. Class III prices settled below the 95% coverage level on 200 out of 263 days (76% of the time), while Class IV prices settled below the 95% coverage level on 194 out of 242 days (80% of the time).

-

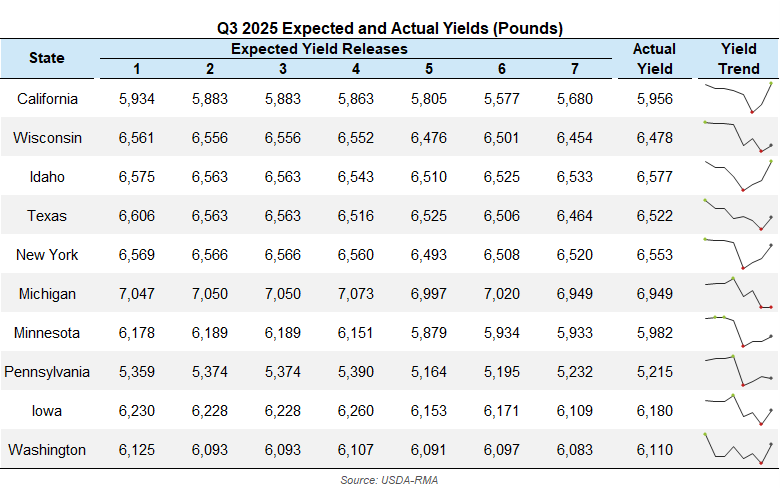

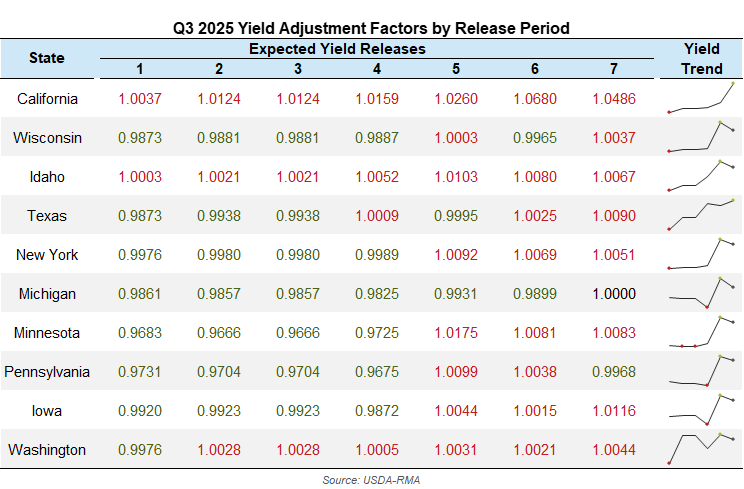

With strong milk yields across most dairy regions, actual production outperformed earlier expectations, especially those closer to the coverage closing date. While most states experienced only modest impacts, California’s yield adjustment factors (YAFs) were particularly detrimental to DRP settlements. Following the bird flu outbreak in late 2024, the DRP yield model was skewed toward reduced production expectations for California, leading to a negative adjustment to expected yields. Contrary to the model, milk output rebounded and increased through Q3 2025, with actual yields coming in 1.2% to 6.8% higher than expected yields. This resulted in a boost to actual revenue, substantially reducing projected losses in that state.

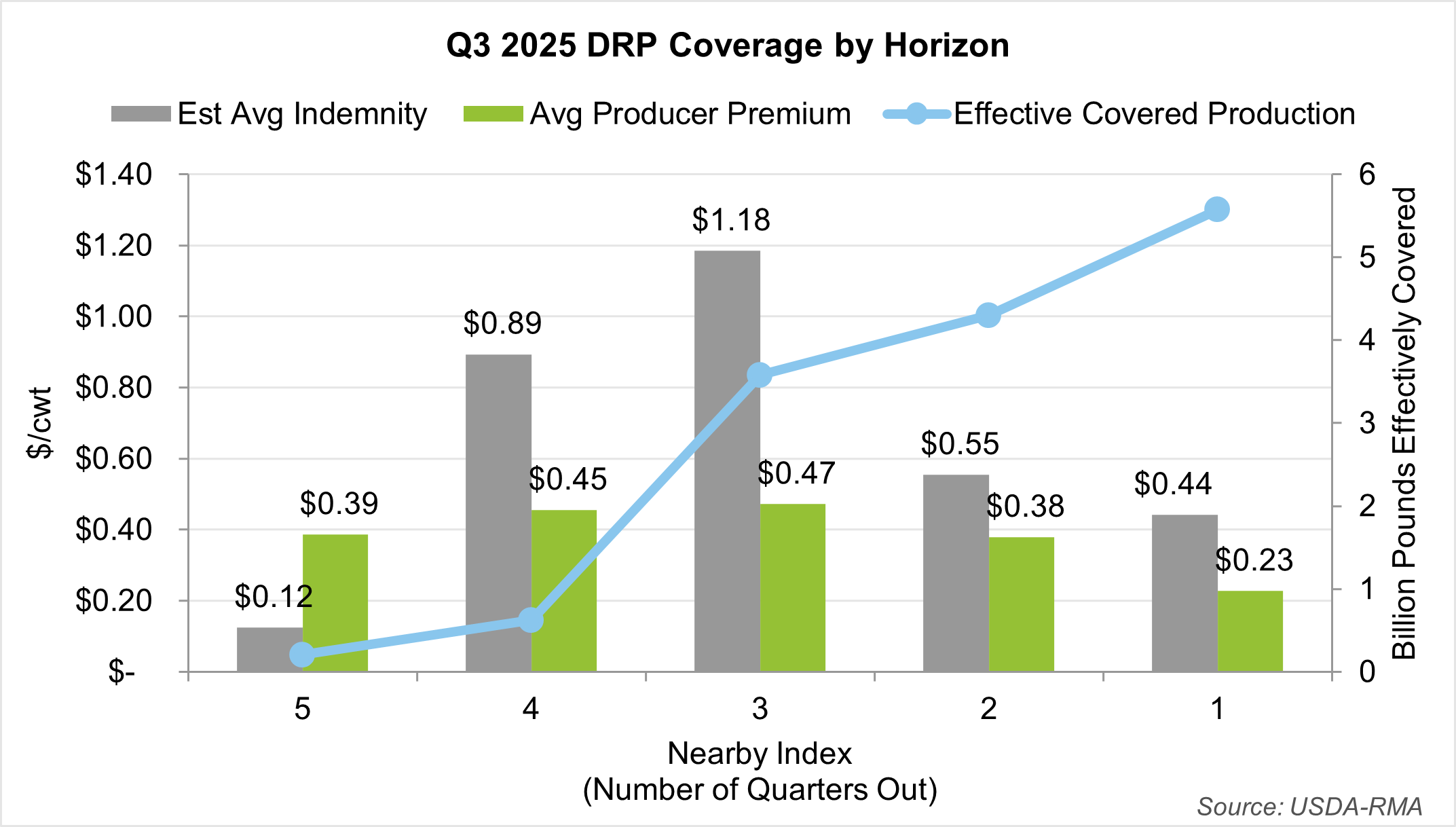

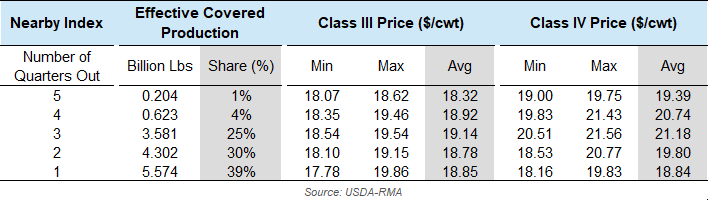

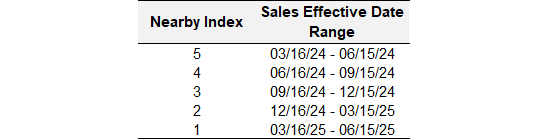

Coverage Performance by Horizon

Note: Class IV coverage was not offered for Q3 2025 until April 23, 2024 (about a month into nearby index 5).

Participation and Performance

Impact of Yield Adjustments

The Yield Adjustment Factor (YAF) is calculated as the state or pooled production region’s actual yield released in USDA’s Milk Production report divided by the expected yield at the time of coverage. The YAF can have a positive or negative impact on indemnity payments:

-

YAF > 1: When the actual yield is greater than the expected yield, the potential indemnity is reduced.

-

YAF < 1: When the actual yield is less than the expected yield, the potential indemnity is enhanced.

Net to producers is equal to the indemnity paid minus the producer premium. Effective covered milk production is equal to the declared production times the protection factor. Class III versus IV coverage is calculated as the effective covered milk production times the class price weighting factor or the component price weighting factor.

Disclaimer: HighGround Insurance Group (HGIG) is an agency affiliated with HighGround Dairy (HGD). HGIG is a licensed insurance agency in many US states. HighGround Dairy is a division of HighGround Trading (HGT), an Introducing Broker (IB) registered under United States Laws. Nothing contained herein shall be construed as a recommendation to buy or sell commodity futures or options on futures. This communication is intended for the sole use of the intended recipient. Futures and options trading involves substantial risk and is not suitable for all investors.