USDA’s January 1, 2025, Cattle Inventory Report, released on January 31, reflected a key theme: DECLINE. Of the 14 data categories, including cows, heifers, steers, bulls, and calves from both beef and dairy sectors, the only one that increased from 2024 was dairy cows, up 2,500 head (0.03% year-over-year).

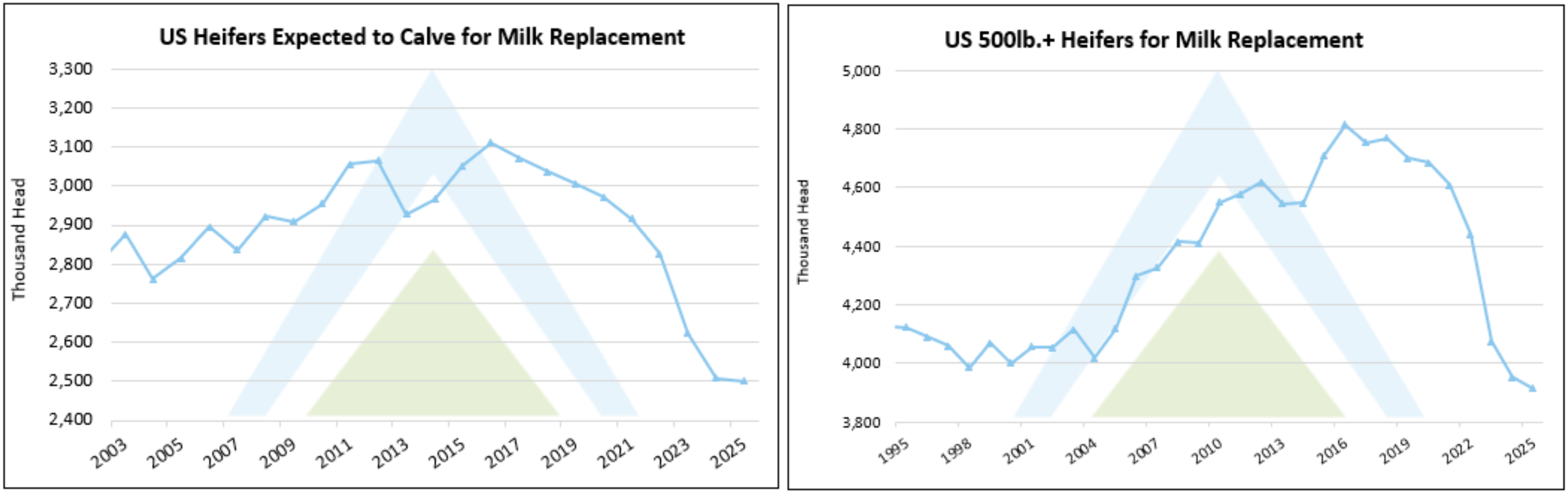

One of the most anticipated figures was the dairy heifer numbers, and inventories remained historically small. Dairy heifers expected to calve totaled 2.5 million head as of January 1, 2025, down 0.4% from the previous year and the lowest level since the dataset began in 2001. The figures for 2023, 2024, and 2025 now represent the three lowest readings in the 25-year history of the dataset. Dairy heifers weighing 500 pounds or more, including those expected to calve, totaled 3.914 million head, a decline of 0.9% year-over-year and the smallest value since 1978. In addition, USDA made downward revisions to the 2024 values for these data points, decreasing heifers expected to calve by 84,500 head (-3.4% of actual) and dropping total dairy heifers by 108,000 (-2.7% of actual). These shrinking figures highlight the ongoing trend of dairy farmers breeding cows to beef bulls, rather than dairy bulls, to produce higher-value crossbred calves that can be sold at a few days old for a nice price.

Beef prices are at all-time highs: February and April 2025 Live Cattle futures contracts surpassed $200 per hundredweight the week ending January 25. Despite these lofty prices, demand for beef remains strong, and supplies continue to tighten, keeping upward pressure on prices. As of January 1, 2025, the total number of beef cows in the U.S. was 27.9 million, a 0.5% decline from the previous year and the lowest level since 1961. The number of heifers weighing 500 pounds or more dropped 1.0% year-over-year to 4.672 million, marking the smallest inventory since 1949. Since beef cows and heifers are needed to rebuild the beef herd, these numbers suggest that cattle supplies will remain tight and prices will stay elevated.

The limited supply of breeding stock in the beef sector continues to encourage dairy producers to breed cows to beef bulls to increase revenue. However, dairy farmers are becoming more precise in managing replacement inventories. With dairy heifer numbers at near-50-year lows, it seems operations have adjusted their strategies to retain only the necessary number of replacements. Those looking to expand are likely adopting breeding plans to ensure self-sufficiency in heifer supply rather than relying on outside purchases, as they did when heifers were more readily available (and cheaper) at sale barns. Additionally, some farms are keeping cows in production longer to recoup the costs of raising replacements, extending their productive life before culling.

Monitoring these numbers will be critical, given the current levels. It will take time to rebuild the beef herd, and while those numbers recover, it seems likely that prices will remain elevated. This will continue to encourage dairies to breed beef genetics. Additionally, with limited opportunities for dairy farmers to expand, particularly in some regions of the country, breeding for beef animals looks especially enticing. The tight dairy heifer numbers create risk, though, as cows age, and the longer-term effects of avian influenza on dairy cows remain unknown. Unforeseen events could lead to a need for more replacements, potentially creating a bottleneck.

For now, USDA plans to issue its July 1 Cattle Inventory report on July 25, 2025, after skipping the July 1 publication in 2024, which will provide an update on the situation.