Global food prices skyrocketed over the past year and a half from a myriad of supply chain struggles as the world slowly returned to a more normal pace following the COVID-19 pandemic.

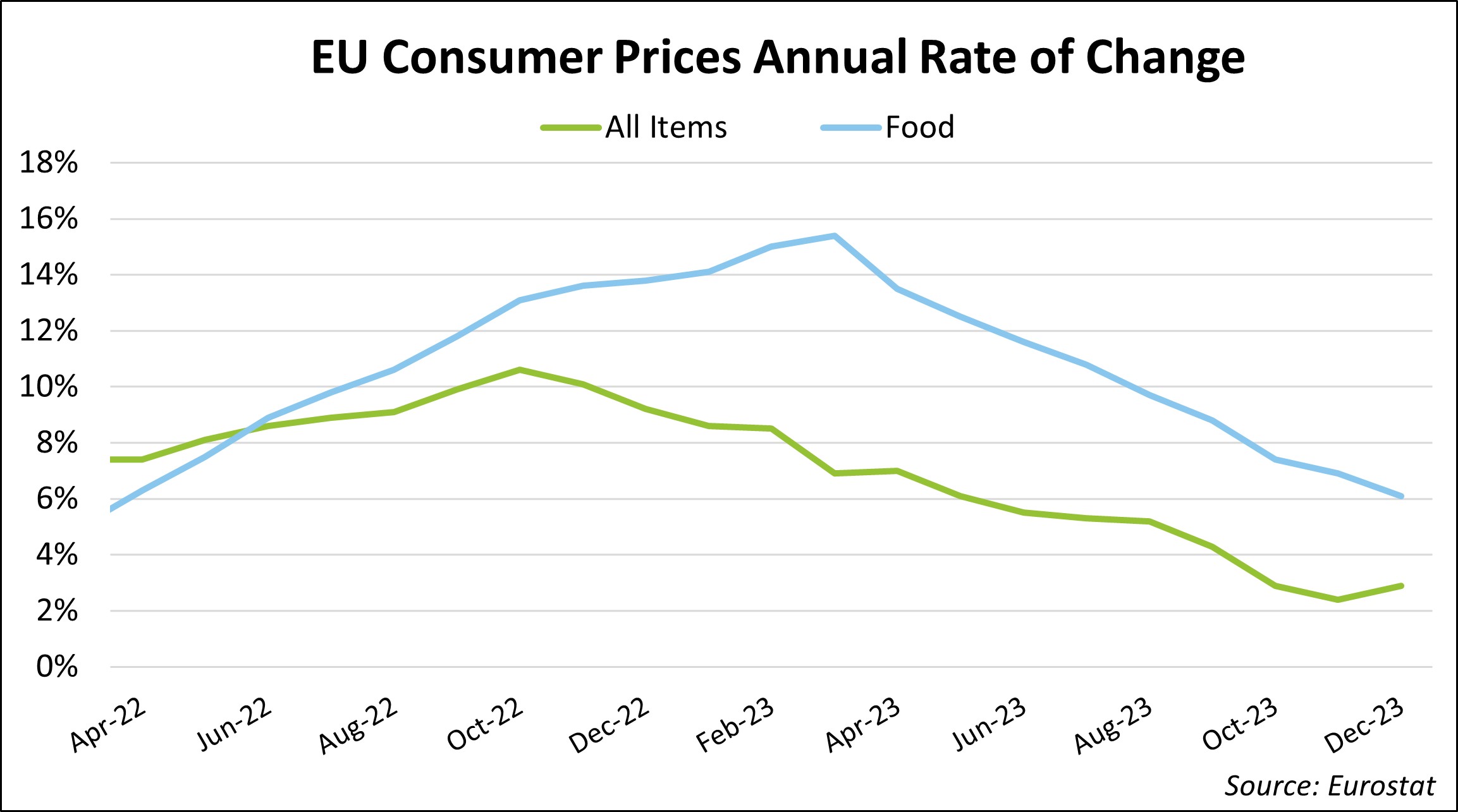

In March 2023, food inflation in the European Union reached an all-time high of 15.5% since the formation of the Eurostat reporting agency in 1997. Although inflation has been decelerating month-over-month through the rest of 2023, it remains significantly higher than consumers have seen in previous years, and remains positive, indicating that while prices are not rising at the rate they once were, they still continue to increase, nonetheless. As supply chain constraints allayed and global commodity prices fell, Europeans became frustrated as food prices kept climbing higher and began to push back at the supermarket and in parliament.

France took the lead against higher food costs back in June 2023, when Finance Minister Bruno Le Maire announced that 75 of the top food companies in the country agreed to cut or cap prices on hundreds of products between July and September to help alleviate the financial burden that French consumers were facing. Furthermore, in August 2023, the Minister reported that an additional 5,000 products would face price-caps, noting that the affected items made up around a quarter of the typical supermarket’s offerings. However, while the regulations were a valiant effort to reduce grocery costs, the government failed to account for one tick up suppliers’ sleeves, shrinkflation.

Shrinkflation is the practice of decreasing a product’s size or quantity, and/or reformulating or reducing the quality of the product while continuing to offer it at the same price. The word was officially added to the Merriam-Webster dictionary in September 2022 after the phenomenon went viral on social media as people from around the globe took to the internet to showcase products they regularly purchased at the same price, but unbeknownst to them, in a smaller size. Once the trick got out, it spread quickly garnering backlash from both shoppers and retailers.

In September 2023, Carrefour, a multi-national supermarket chain with roughly 14,383 stores across Europe, began adding stickers to products that shrank in size while the cost stayed the same. The goal behind the effort was to raise awareness from consumers and rally support ahead of supplier negotiations that were set to begin in mid-October. However, on January 4, 2024, the company took their stance one step further announcing that it would no longer sell PepsiCo products at over 9,000 stores across France, Italy, Spain, and Belgium. PepsiCo disclosed in its latest quarterly earnings report the intention for another “modest” price hike before the end of 2023 and raised their profit forecast for the third consecutive time. The move to de-list PepsiCo items from its shelves also comes after the French government asked retails and suppliers to finish annual price negotiations in January, two months sooner than usual.

In the same breath, the French government submitted a draft decree to the European Commission that aims to require French food retailers to notify consumers when the size of a product decreases but the price remains the same. This is not the first case of government policing of shrinkflation techniques though. Starting in 2024, South Korea will require companies to disclose on their packing and website when grocery items drop in volume but not price. The government also established a price-investigation team to monitor compliance of suppliers with the potential for hefty fines if in violation of the law.

Now, with drought hindering passage through the Panama Canal and political risks diverting cargo from the Suez Canal to trek around the southern horn of Africa, shipping rates have skyrocketed, raising anxieties that suppliers will once again raise prices, or shrink sizes, to offset higher operational costs. But this time, with the cat-out-of-the-bag on shrinkflation, companies who continue to shrink portion sizes while keeping prices the same may risk greater consumer retaliation. Already under financial strain, shoppers have little cash, or patience, left to give. If outrage increases, more food retailers may follow Carrefour’s lead, and more consumers may demand greater regulation of manufacturers. In 2024, consumer trust will be all that more important to keep products moving, or even on the shelves at all.

Cara Murphy: Dairy Market Intelligence Manager, HighGround Dairy

Cara Murphy is originally from Des Moines, Iowa where she grew up raising beef cattle. Her passion for agriculture led her to receive a Bachelor of Science degree in Animal Science from Iowa State University. Cara joins us with experience in international agriculture market analysis and economic analysis having spent three years as a member of the market and business insights team with Vermeer Corporation. Her background and strategic mindset provide customers with a holistic viewpoint on changing market dynamics.