Overview & Key Points

-

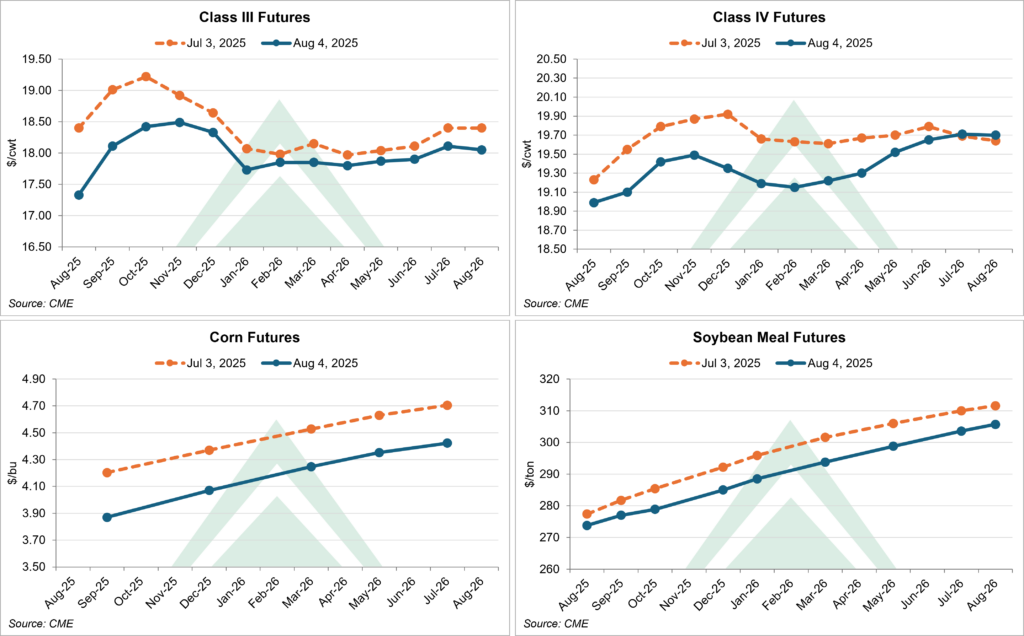

Class III and Class IV milk futures declined over the past month as dairy product futures, including butter, cheese, and dry whey, moved lower. Butter futures saw the largest drop, falling by double digits for contracts through March 2026. This was driven by a $0.1425/lb. decline in the CME spot butter price, representing a decrease of 5.5%. Cheese futures, which were trading at a notable premium to spot prices last month, also fell, along with dry whey futures. These declines contributed to lower Class III values, particularly in nearby months.

-

Significant declines in feed costs have helped cushion the impact of lower margins compared to last month. Favorable weather has led the market to expect large corn and soybean harvests this year. Combined with ongoing trade concerns, the supply outlook for both crops appears poised to outpace demand in the year ahead, adding further pressure to feed markets.

-

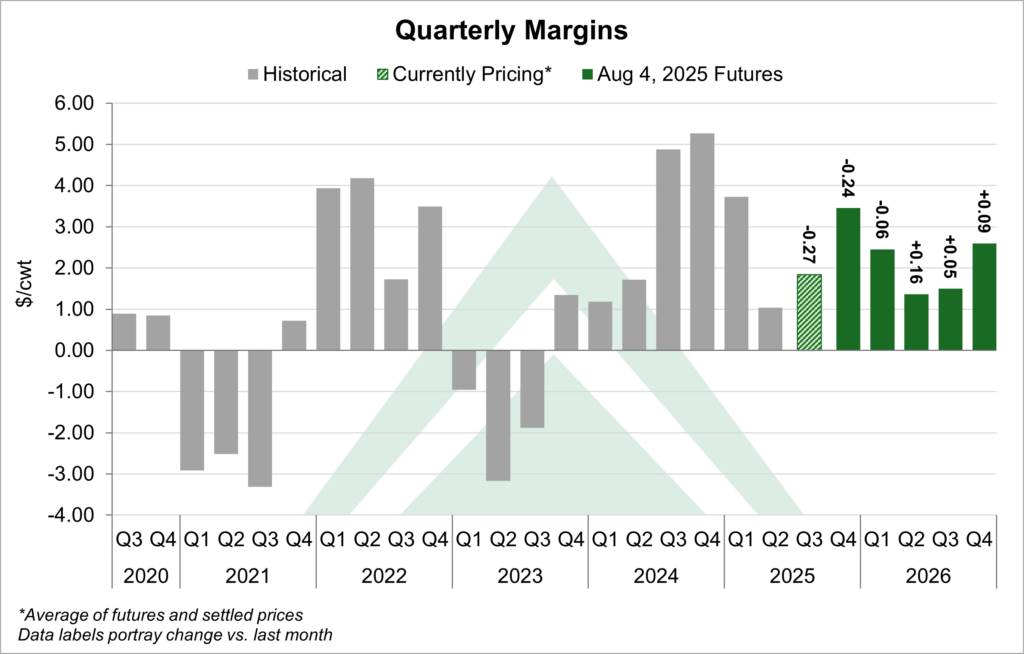

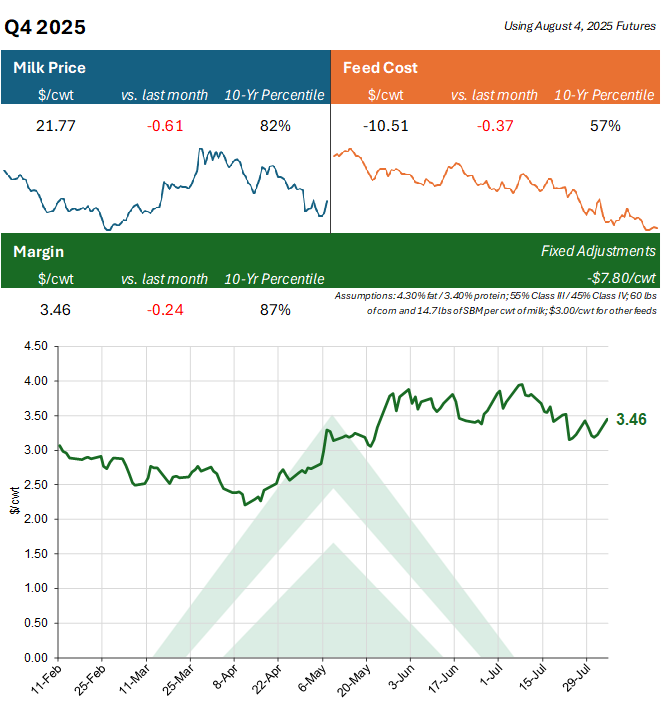

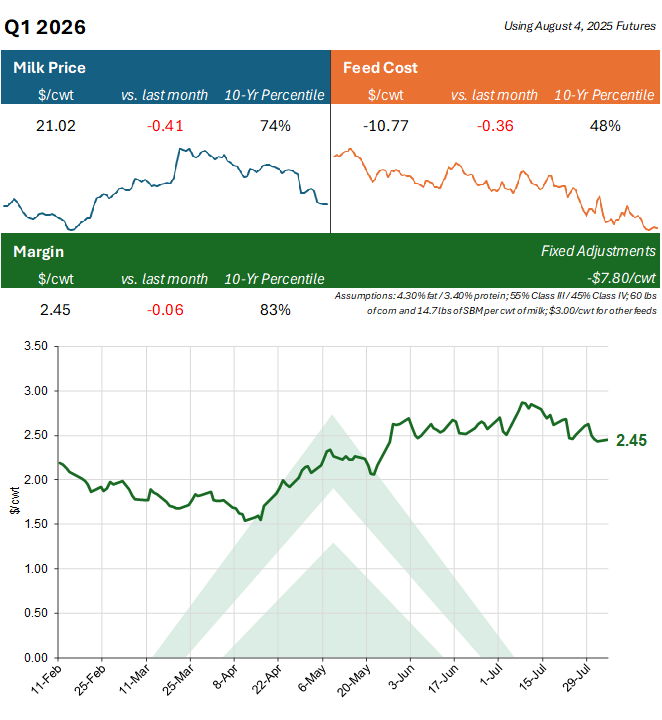

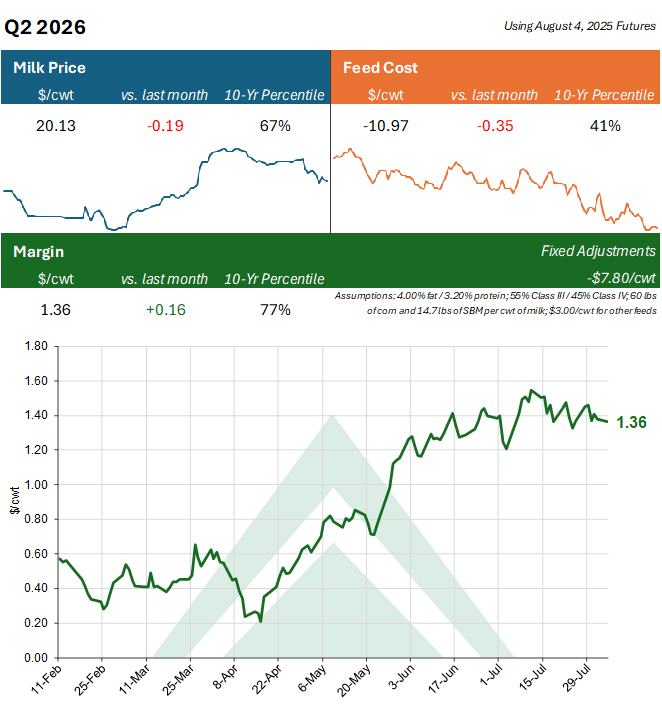

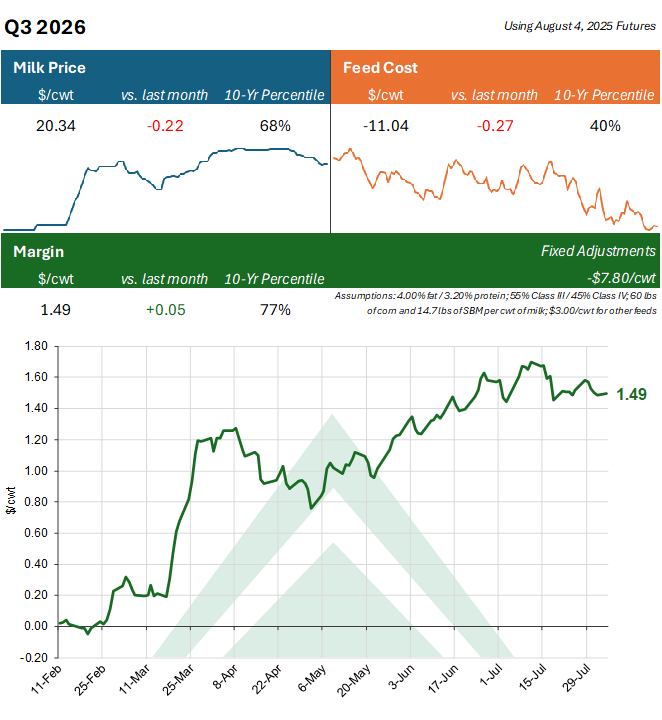

With lower milk prices more than offsetting lower feed costs, projected margins for nearby quarters decreased modestly from last month. Despite the nearby declines, margins in the second half of 2025 and full year of 2026 remain favorable, ranking above the 75th percentile in every quarter. With this in mind, HighGround continues to urge producers to proactively secure margins out into 2026.

Change in CME Futures from Last Month

Projected Margins by Quarter

This report is intended to be a simple barometer of the margin potential for dairy farms in the United States. This is not necessarily an accurate measure of a specific farm’s profitability, as margins can vary greatly from farm to farm. If you are interested in customizing this model to your operation, please email us at info@highgrounddairy.com to learn more.

Beginning with June 2025, milk price projections utilize the new FMMO pricing formulas set forth in USDA’s Final Rule released on January 17, 2025. A negative change in feed cost vs. prior week means feed prices decreased. Percentiles compare the listed price to quarters with the previous ten years of data. Higher percentiles represent greater historical benefits to producers.

Assumptions: All projections are estimated on an accrual basis. Quarterly margins are determined using current CME futures prices for dairy products, corn, and soybean meal. Milk prices are derived from CME dairy product futures and adjusted for component levels and class utilization. Assumed component levels by quarter are: 4.30% BF / 3.40% PRO in Q1 & Q4 and 4.00% BF / 3.20% PRO in Q2 & Q3. Component estimates are based on recent data available for milk composition levels across the US. Class utilization is set to 55% Class III / 45% Class IV. Feed costs are calculated using CME corn and soybean meal futures (“correlated feeds”) and a fixed value for non-correlated feeds at $3.00/cwt. Correlated feed costs are based on the assumption that 60 lbs of corn (or its equivalents) and 14.7 lbs of soybean meal (or its equivalents) are required to produce 100 lbs of milk. A basis adjustment of +$1.00/bushel is added to corn futures, and no basis is added to soybean meal futures. The remaining adjustments are fixed at: -$8.00/cwt for total non-feed costs; -$1.30/cwt for milk check premiums/deductions; and +$1.50 for non-milk revenue.

Disclaimer: HighGround Insurance Group (HGIG) is an agency affiliated with HighGround Dairy (HGD). HGIG is a licensed insurance agency in many US states. HighGround Dairy is a division of HighGround Trading (HGT), an Introducing Broker (IB) registered under United States Laws. Nothing contained herein shall be construed as a recommendation to buy or sell commodity futures or options on futures. This communication is intended for the sole use of the intended recipient. Futures and options trading involves substantial risk and is not suitable for all investors.