Monday Morning Huddle

1 May 2023

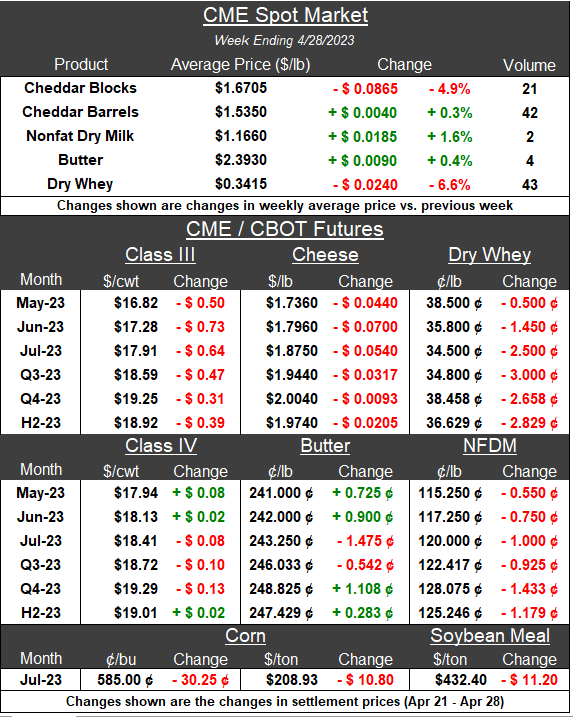

Spot Cheese Sets New 2023 Lows, Then Rallies:

Blocks and barrels made new 2023 lows this past week after a very quiet day of trading on Monday, with just one load of Cheddar barrels moving. On Tuesday the bears emerged, as barrels settled at $1.4750/lb., a level not seen since November 2021. Wednesday was the low watermark for blocks, with a close at $1.6425/lb., another price not seen in a year and a half. While volumes for both commodities were lower than the previous week, they were above the 2023 weekly averages. With spring flush rolling along in the Northern Hemisphere, vats are full, and processors are currently favoring American-style cheeses like Cheddar as exports slow and domestic demand for other cheese, like Mozzarella and hard-Italian styles wanes.

Cold Storage is a Little Bullish, a Little Bearish:

USDA released March’s Cold Storage report on Tuesday, with butter stocks falling from February to March by 2.3 million pounds, counter to the five-year seasonal build of 12.6 million pounds. While inventories increased YoY, UP 3.5% compared to March 2022, the growth is decelerating relative to the previous month’s year-on-year jumps. With churns reportedly running actively in March, according to Dairy Market News, perhaps domestic demand is improving and drawing down stocks, or the early Easter holiday pulled volume forward.

On the other hand, total cheese stocks were below March 2022 and 2021’s figures; however, those years rank #1 and #2 for inventories, with 2023 coming in a close #3. Versus prior month, total cheese rose by 0.9% following the standard build from February to March. American cheese stocks carried the day, as inventories expanded 15.3 million pounds in March from February, much higher than the five-year average of a 3.6 million pound rise. Because of the cheap milk in the Upper Midwest, a Class III heavy market, processors are pushing the excess milk into cheese, particularly varieties that are tradable and storable, like Cheddar.

US GDP Grows at a Slower Rate Than Expected:

US GDP grew at a rate of 1.1% in the first quarter of 2023, according to the US Bureau of Economic Analysis. Analysts had expected an increase closer to 2% after the third and fourth quarter of 2022 showed advancements of 3.2% and 2.6%, respectively. According to The Conference Board, consumer confidence decreased from March to April, and the Expectations Index remained below 80, described as “(a) level associated with a recession within the next year.” This data points to the headwinds and worries that have been present in the market for some time, and some say the US is in a period of stagflation.

ADPI in One Word, Bearish:

Dairy market participants from around the globe gathered in Chicago last week for the American Dairy Products Institute’s Annual Conference. The HighGround team was hard-pressed to find optimism about current market conditions. While supply is growing in the US and Europe, it is not by much and could wind down after spring flush. The bigger story was demand, with contacts sharing that buying is lukewarm as recession worries continue. Until macroeconomic concerns subside, making a case for higher prices for at least the next few months will be challenging as sellers work through heavy supplies and whittle down some of their reserves.

Last Week’s Reports & Analysis

March & Q1 China Dairy Import Volume Analysis

Overall Mar ‘23 dairy imports are reported as increasing, up 1.73% YoY, comprised of growth from imports of whey, SMP, infant formula, cheese, lactose and casein. Large gains within these categories…Full Report

Pre-GDT Forecast Volume Analysis

This expectation of a bounce is interesting when leveraging against fundamentals, however this week’s GDT Pulse event somewhat agrees with this sentiment. As a reminder, GDT Pulse WMP shifted $100/metric ton higher from the previous GDT Pulse auction, and $50/MT above the same…Full Report

Reports This Week

- EEX Market Closed (May Day/Labour Day) – Monday, May 1

- Crop Progress Report – Monday, May 1

- Global Dairy Trade Auction – Tuesday, May 2

- Weekly EU Dairy Commodity Prices – Wednesday, May 3

- Apr ’23 USDA Announcement of Class & Component Prices – Wednesday May 3

- Weekly National Dairy Products Sales Report (NDPSR) – Wednesday, May 3

- March ’23 US Trade Data – Thursday, May 4

- USDA Dairy Market News Weekly Midpoint Prices – Thursday, May 4

- USDA Weekly Dairy Cow Slaughter – Thursday, May 4

- Mar ’23 US Dairy Products Production & Dry Stocks Report – Friday, May 5