Monday Morning Huddle

10 April 2023

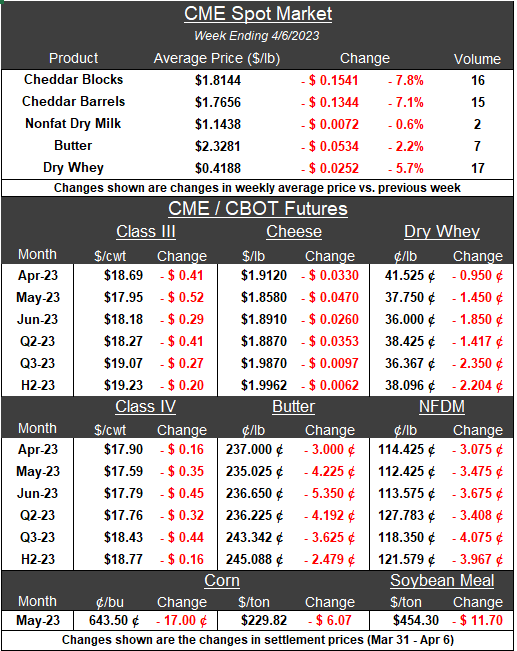

CME Spot Markets Fall:

The weekly averages for all CME spot commodities were DOWN vs. the previous week. Cheese markets were in a tailspin two weeks ago, but the deceleration slowed during the holiday-shortened week. Notably, blocks and barrels traded at the same price last Monday, the first time parity has occurred in that market since November 1, 2022, and more Cheddar blocks than barrels were sold, which has not happened since the week ending December 31, 2022. Blocks have gone on a wild ride, starting from $1.78/lb. on March 10, their lowest value since September 2022, to $2.10/lb. on March 24, and slamming back to the low $1.80s last week. Barrels have lost 12% of their value in the previous eight trading sessions.

On Thursday, nonfat dry milk (NFDM) settled at its lowest price in over two years, as demand for skim milk powder and NFDM is reportedly slowing internationally and domestically. After spending almost all of February and March over $0.40/lb., whey moved decidedly lower on Thursday, giving up 4.5 cents and closing under that mark. Butter markets also headed back to levels not seen since January. The falling prices at the CME fit with the market fundamentals that have been playing out in 2023 as US prices attempt to align with the international market.

Supply Outpacing Demand for US Dairy:

USDA released its February Dairy Products report this past Monday, with cheese, butter, and NFDM/SMP production increasing against February 2022. Cheese production set a February record, despite very strong comparisons in 2022 and 2021, likely due to the robust milk volumes in the Upper Midwest. Whey production fell compared to February 2022, but stocks built, indicating abysmal demand. Combined NFDM and SMP output grew 8% annually, while stocks totaled 310 million pounds, a jump of 14.6% YoY, indicating the market is heavy with product driven by cautious buying from abroad.

February export data, released Wednesday, showed volumes slowing for US dairy products abroad. However, for cheese and NFDM/SMP, where shipments fell 0.2% and 0.5% against February 2022, Mexican demand saved the day, with SMP exports to the United States’ southern neighbor surging 43% and cheese rising 11% relative to the same month in 2022. Mexico is faring better than other parts of the developing world as the peso has strengthened recently. That said, exports to Asian markets, sans China, fell in February 2023 YoY. US dairy exports are not likely to increase at least through the third quarter of 2023 as prices on many dairy commodities are not competitive with the rest of the world, and other nations face economic uncertainty coupled with high inflation.

Last Week’s Reports & Analysis

February 2023 Dairy Products Report Analysis

Total cheese production in the US topped 1.1 billion pounds, a modest increase of 0.4% versus February 2022 and the 28th month in a row of an annual increase…Full Report

Comprehensive GDT Auction Analysis

The race to the bottom continues, with the physical market again leading the way, further than what SGX futures traders were anticipating. With market participants still heavily focused on when China’s recovery will start dragging prices higher, it will come as a nasty surprise to note that there were 10 fewer winning bidders from North Asia than at the…Full Report

Reports This Week

- EEX & SGX/NZX Dairy Futures Markets CLOSED – Monday, April 10 (Easter)

- GDT Pulse Auction #020 – Tuesday, April 11

- Apr ’23 World Ag Supply & Demand Estimates (WASDE) – Tuesday, April 11

- Weekly EU Dairy Commodity Prices – Wednesday, April 12

- Feb ’23 USDA-ERS Dairy Supply & Utilization Report – Wednesday, April 12

- Weekly National Dairy Products Sales Report (NDPSR) – Wednesday, April 12

- Pre-GDT Fonterra Offer Volume Estimates – Thursday, April 13

- USDA Dairy Market News Weekly Midpoint Prices – Thursday, April 13

- USDA Weekly Dairy Cow Slaughter – Thursday, April 13