Monday Morning Huddle

15 May 2023

Blocks Go Lower:

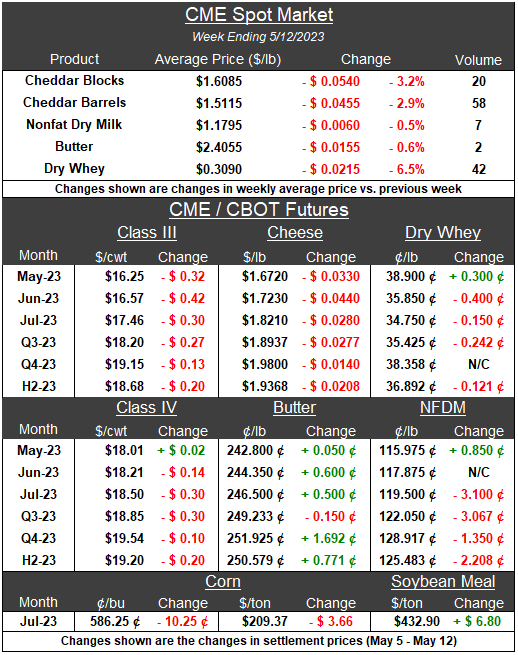

CME Cheddar blocks set another 2023 low in Friday’s trading, settling at $1.53/lb., their lowest point since July 2021, with 11 loads trading, totaling 20 for the week. Barrels continued to find solid buying support near $1.50/lb., as 58 lots were exchanged last week.

Whey Sets a New Low:

Blocks and barrels were not the only commodities facing downward pressure last week, as CME spot whey set a 2023 low of $0.30/lb. in Thursday’s session, its lowest CME value since July 2020. It was another week of solid volumes with 42 loads traded, as buyers have been eager to acquire dry whey in 2023 on downward market moves. National Dairy Product Sales Report (NDPSR) prices have been in decline, but remain above $0.40/lb., though, as the lower price CME sales begin to filter into both the Dairy Market News mostly average and NDPSR indices.

WMP Prices Decline at GDT Pulse:

After two positive GDT auctions (April 18 and May 2) and a higher GDT Pulse (April 25) result, WMP settled $15/MT lower on last week’s GDT Pulse result compared to the prior auction. Last week’s negative result appears to have halted recent bullish momentum in the global powder markets, with WMP/SMP/NFDM futures finding resistance across multiple exchanges.

WASDE Sends New Crop Corn and Beans Lower:

USDA released its World Agricultural Supply and Demand Estimates on Friday, with the 2023-24 crop estimates included in the report for the first time. Corn and soybean production is forecasted at all-time highs, driven by expected record yields. Ending stocks for both commodities in 2023-24 are higher than in 2022-23, with corn inventories estimated at 2.22 billion bushels- a substantial 805 million bushel increase from the previous season. Soybean and corn exports are pegged at four-year lows.

US Approaches Debt Ceiling:

President Biden will continue meeting with congressional leaders this week to negotiate raising the US’ debt ceiling, i.e., the amount of debt the US government can take on or the amount of money it can borrow. Treasury Secretary Janet Yellen has warned that the US could run out of borrowing capacity by June 1. If the measure is not raised, the US stands to default on its debts which would likely cause upheaval in financial markets and hurt the US economy. The US has never defaulted on its debts.

Forecast Week at HighGround:

Watch for our May forecast, released later today, and sign up for tomorrow’s Forecast Webinar to get the in-depth details. On Tuesday, the GDT Auction will help explain if last week’s downturn at the Pulse was just a blip or a new move downward. US April Milk Production will be released on Friday, with many expecting to see record-high milk in the Midwest as 2023 continues to pump out very low spot milk prices into the spring months (last week at $4 to $12 under Class pricing).

Last Week’s Reports & Analysis

Pre-GDT Forecast Volume Analysis

Fonterra is due to release their forecast farm gate milk price for the coming season next week, which will set the tone for 2023-24 for Kiwi dairy farmers. The volatility of the global market has been clearly illustrated by the SGX -NZX milk price future associated with the coming season, with this contract still jumping around wildly before…Full Report

Weekly EU Dairy Commodity Prices

There has been somewhat of a revival in the powder market over the past week with prices for SMP and WMP moving upwards. This is likely due to the recent tender from Algeria, but improved demand from the Middle East is also being reported. However, whole milk powder prices settled lower on yesterday’s GDT Pulse auction, breaking three consecutive weeks of gains…Full Report

Reports This Week

- Mar ’23 US Dairy Supply & Utilization Report – Monday May 15

- Crop Progress Report – Monday, May 15

- HighGround Dairy Monthly Forecast Snapshot Report – Monday, May 15

- Global Dairy Trade Auction – Tuesday, May 16

- HighGround Dairy Monthly Outlook Webinar – Tuesday, May 16

- Mar ’23 EU Trade Data – Tuesday, May 16

- Weekly EU Dairy Commodity Prices – Wednesday, May 17

- Mar ’23 EU Milk Production Data – Wednesday, May 17

- Weekly National Dairy Products Sales Report (NDPSR) – Wednesday, May 17

- Jun ’23 USDA Advanced Prices & Pricing Factors (Class I) – Wednesday, May 17

- USDA Dairy Market News Weekly Midpoint Prices – Thursday, May 18

- USDA Weekly Dairy Cow Slaughter – Thursday, May 18

- Apr ’23 New Zealand Trade Data – Friday, May 19

- Apr ’23 US Milk Production Report – Friday, May 19