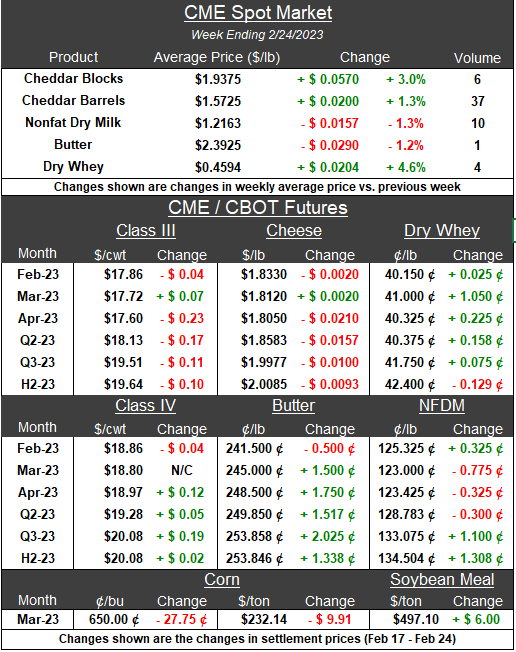

Mixed CME Results Last Week:

Block and barrel price averages were higher this week over last, but after jumping eight cents on Tuesday (the first day of trading due to holiday-shortened week), blocks gave up their gains and ended the week at $1.88 per pound, the same as the previous Friday. Whey continued to rise in CME spot trade this week, settling on Friday at $0.465 per pound, its highest level in 2023. On the other hand, NDPSR whey values trended lower and remained below 40 cents for the second consecutive week. With most whey physical contracts pegged to NDPSR values, it is best to temper excitement about the rising whey prices in spot trade. Butter’s weekly average came in less than $2.40 per pound and lower than the previous week, despite a Friday rally. Export demand has dried up for butter, and butter stocks are no longer dwindling, so prices have the potential to move lower.

Lower GDT and Strong NZ Exports:

The overall Global Dairy Trade Index was DOWN 1.5% vs. two weeks ago, led by losses in the powder complex. Although a cyclone hit the islands, this did not spark a rally on the auction this past week, and macroeconomic concerns likely drove the weaker demand. Export data for January showed strong sales to Southeast Asia, which may be opportunistically buying cheap products.

US Milk Supplies Grew in January:

January milk production across all states was UP 1.3% from January 2022, near expectations, with the herd growing 9,000 head from December, a bit surprising given strong slaughter in January. On the demand side, butter stocks grew at the average seasonal rate, neutral to expectations, totaling 262.7 million pounds, UP 46.4 million pounds from December 2022, according to the Cold Storage report released on Friday. Total cheese stocks, though, were DOWN 0.3% yearly and monthly, weighing in at 1.441 billion pounds, eschewing the typical seasonal build from December to January and driven by falling Natural American cheese stocks. The lighter-than-expected cheese stocks are likely due to more robust demand, as milk supplies in Class III pools were abundant in January.

Blizzard in California:

A major storm hit California late last week into the weekend, prompting blizzard and flash flood warnings throughout the state. The precipitation could disrupt the travel and movement of milk in the country’s number one dairy state.

What’s On Tap This Week?

USDA will announce Feb ’23 Class and Component Prices on Wednesday, March 2. January US Dairy Products Production & Dry Stocks Report will be released this Friday, March 3, which will provide more insights into the current US situation. For now, milk supply is healthy both in the US and Europe, with domestic prices higher than the rest of the world which means exports are not competitive. HighGround believes in the short term, there is not much room for upside in the foreseeable future. Weak on-farm margins will eventually cause the milking herd to decline in the coming months, pushing supply and demand back in balance and supporting the market during the second half of 2023.

Last Week’s Reports & Analysis

January 2023 NZ Dairy Export Volume & Production Analysis

January was an impressive month for New Zealand export volumes, which makes sense considering the significant consolidation in global dairy prices at the beginning of Q4. The lower prices brought pockets of…Full Report

January 2023 US Milk Production Report Analysis

Expectations for Jan ‘23 milk production growth to eclipse Q4 2022 levels were high, especially when comparing against a 1.6% year-on-year DECREASE in…Full Report

Reports This Week

- GDT Pulse – Tuesday, February 28

- Feb ’23 US Agricultural Prices Report – Tuesday, February 28

- 2022 US Cold Storage Annual Summary – Tuesday, February 28

- Feb ’23 USDA Announced Class & Component Prices – Wednesday, March 1

- Weekly National Dairy Products Sales Report (NDPSR) – Wednesday, March 1

- USDA Dairy Market News Weekly Midpoint Prices – Thursday, March 2

- USDA Weekly Dairy Cow Slaughter – Thursday, March 2

- Jan ’23 US Dairy Products Report – Friday, March 3