Class IV Products & Dry Whey Find Support

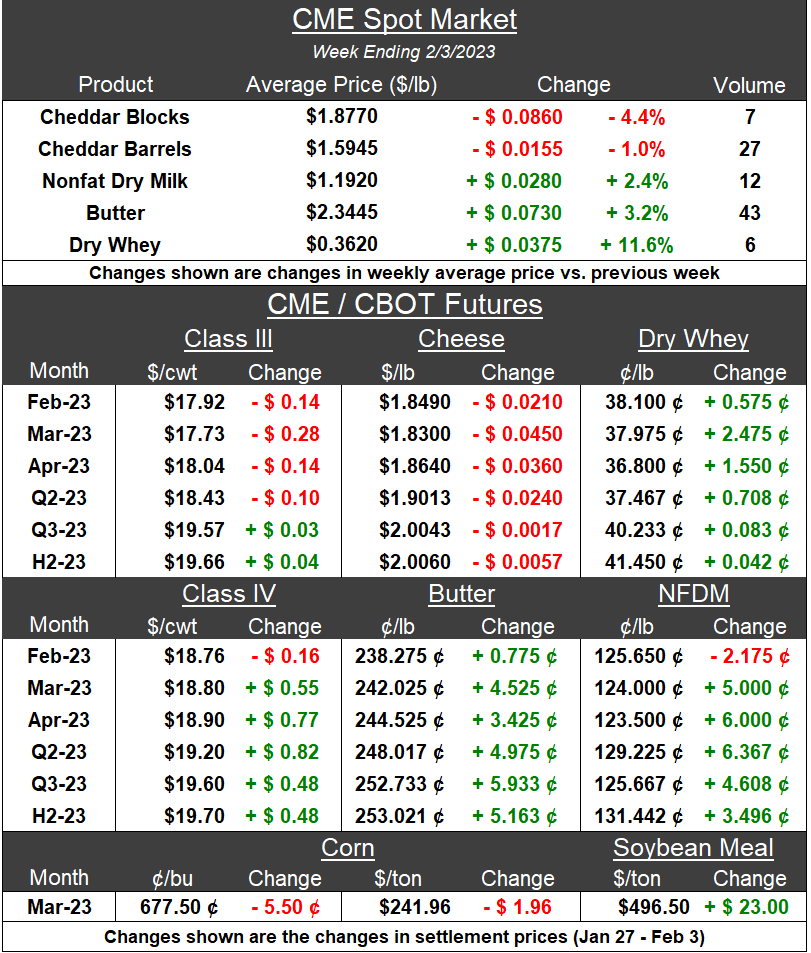

While HighGround expected to find support in the markets after the IDFA Dairy Forum concluded in Orlando on Wednesday, January 25th, it took an extra week for buyers to step back in, with CME spot gains coming from both dry whey as well as the Class IV product complex. Dry whey led the way higher, with the weekly CME spot average increasing by more than 11.5% ($0.0375/lb) from the previous week, its first gain in four weeks and settling Friday at its highest price ($0.4150/lb) since January 5th. The CME spot nonfat dry milk weekly average also climbed higher for the first time in eight weeks and butter also moved higher, though found resistance at the $2.40 level with stronger volume. CME spot cheese saw the block/barrel spread converge this past week, peaking out at a block premium of $0.4075/lb on Jan 27th and declining to $0.2350 by Feb 3.

Why the price strength? There have been some interesting headlines over the past couple of weeks around US milk supplies coming in below expectations and heifer inventories remain low, but in reality, bear markets typically do not fall in a straight line and buyers have come in to secure needs at very attractive levels. It is difficult for HighGround to suggest that given the current fundamental outlook, that a bottom has been found on any of these markets. But a temporary upward correction may be underway and could last for a few weeks before running into resistance.

Jan ’23 US Replacement Heifers Lower for 7th Straight Year

USDA published its semi-annual Cattle Inventory report last Tuesday (Jan 31), and the most important data within the report for the dairy industry are the heifers “expected to calve” for milk replacement. As of Jan 1, 2023, USDA is reporting that number to be 2.7694 million, a 2.01% drop from 2022 and the seventh straight year-on-year decline. This figure is over 5% below two years ago and since 2016, milk replacement heifers expected to calve has fallen by over 342,000, or nearly 11%. This is important as there continues to be less and less available cows to enter the milking herd for when on-farm margins become profitable. According to USDA’s Weekly Dairy Cow Slaughter report (published each Thursday), 204,400 head have been culled thus far in 2023 which is up 9% (+16,000 head) from prior year. The culling has been aggressive, suggesting the potential for further milking herd cut in the coming months, even before on-farm profitability shrinks further given the current milk and feed price outlook.

Last Week’s Reports & Analysis

December & Q4 2022 NZ Export & Production Analysis

The 2022 calendar year was defined by quiet demand from China and lackluster milk collections within New Zealand, both of which kept markets balanced overall. Southeast Asia, the Middle East and North Africa helped to counterbalance some losses...Full Report

Pre-GDT Forecast Volume Analysis

What has been deemed ‘Binge Rainfall’ by New Zealand meteorologists, recent storms have made New Zealand’s North Island historically wet for January and February. Torrential rainfall battered Auckland causing major flooding and numerous evacuations. In nearby Bay of Plenty, there was also widespread flooding as well as a landslide that had knocked down…Full Report

Reports This Week

- GDT Auction – Tuesday, February 7

- Jan ’22 US Import/Export Data – Tuesday, February 7

- Weekly EU Dairy Commodity Prices – Wednesday, February 8

- World Agriculture Supply and Demand Estimates Report – Wednesday, February 8

- Weekly National Dairy Products Sales Report (NDPSR) – Wednesday, February 8

- USDA Dairy Market News Midpoint Prices – Thursday, February 9

- USDA Weekly Dairy Cow Slaughter – Thursday, February 9