|

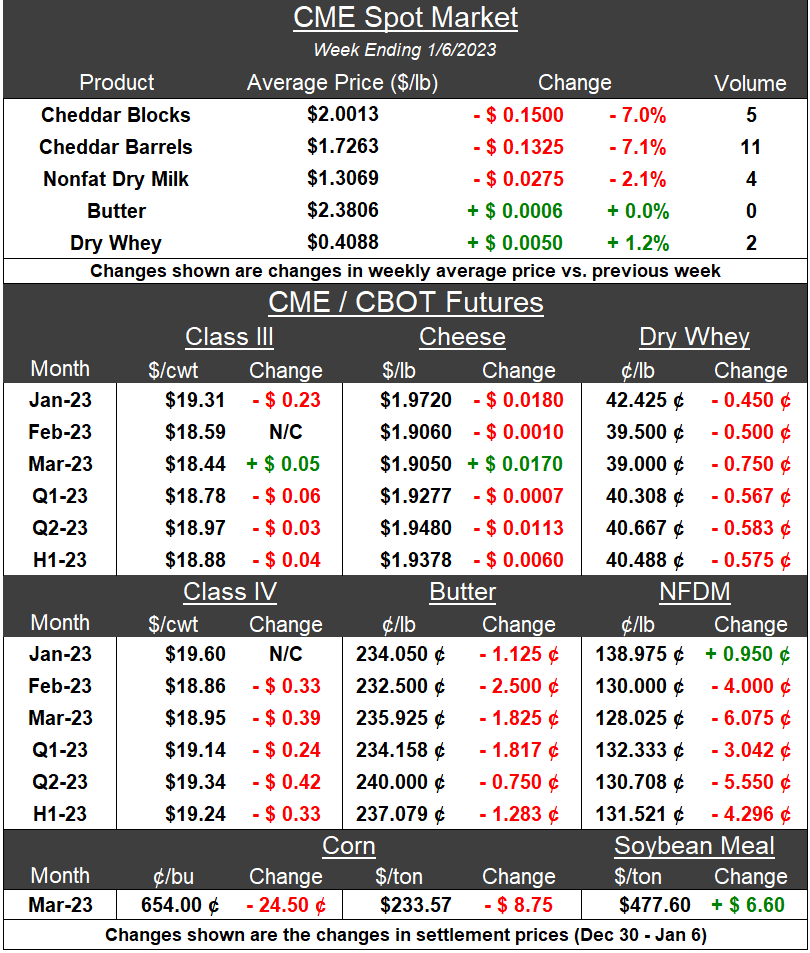

CME Block Prices Flirt With Both Sides of $2.00, NFDM Dips Below $1.30 |

|

China Borders Officially Open Over Weekend |

|

Last Week’s Reports & Analysis |

|

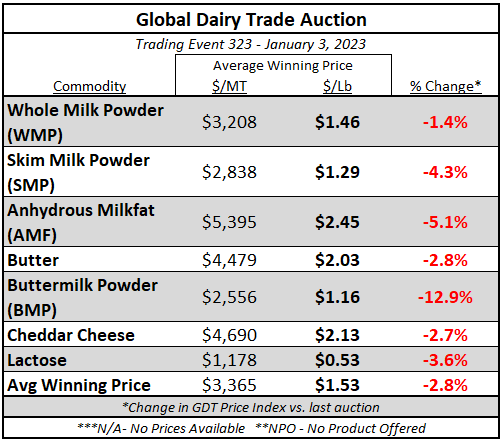

Comprehensive GDT Auction Analysis |

|

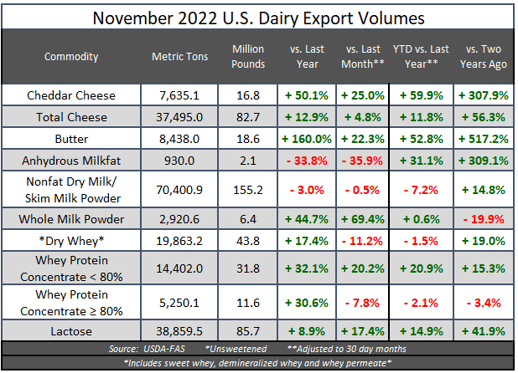

November 2022 US Dairy Trade Analysis |

|

|

|

Reports This Week |

|

|