It is no secret that US dairy farmers have been earning more money from beef in recent months than perhaps ever before. With beef values at record highs, both day-old beef-on-dairy calves and cull cows are contributing meaningfully to dairy farm income, and producers are finding this once-minor revenue stream to be a major driver of profitability.

Understanding the true impact of this added income on dairy farm margins is difficult, as it is not always easy to quantify in real-time due to market reporting timelines. To address this, the team at HighGround built a model using multiple data sources and assumptions to construct a representative dairy operation and estimate beef revenue on a milk-equivalent basis.

Several key assumptions were made for our fictitious herd, including:

- 1,000 milk cows averaging 80 lbs. of milk per cow per day with flat monthly production

- 150 dry cows

- 55% of cows pregnant to beef sires

- 6% calf death loss

- 28% annual cull rate

These assumptions equate to roughly 50 beef-on-dairy calves per month at 85 lbs. per calf and 27 cull cows per month at 1,300 lbs. per cow. We also assumed balanced heifer inventories and a consistent breeding strategy over time. While beef-on-dairy breeding has become more widespread in recent years, maintaining a constant approach across the analysis provides better comparability.

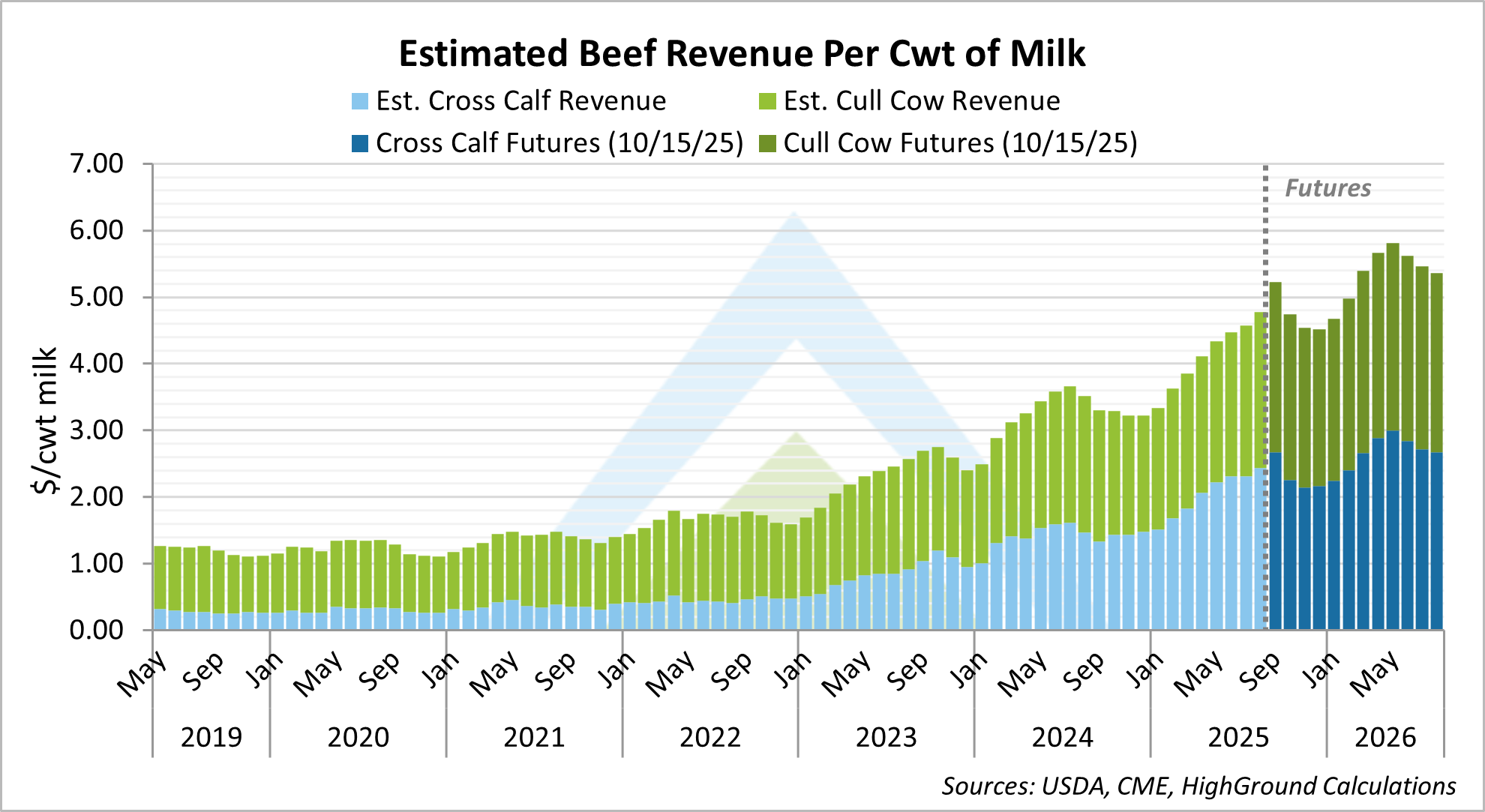

Using these assumptions to translate beef income into dollars per hundredweight ($/cwt) of milk, our model shows that beef revenue is adding a significant boost to dairy farm profitability. On a per-cwt basis, beef income has risen from just over $1.00/cwt five years ago to more than $4.50/cwt today. While cull cow values have strengthened notably, beef-on-dairy calf prices have seen an even more dramatic climb. Between August 2022 and August 2025, estimated cull cow values more than doubled (+113%), while beef-on-dairy calf values surged over sixfold (+533%).

Back in August 2022, our model shows that cull cows represented roughly 74% of total beef income, with beef-cross calves contributing only 26%. Fast forward to August 2025, and that balance has nearly evened out, with 51% from calves and 49% from culls. This shift underscores the increasing financial significance of beef-on-dairy programs, even under a stable breeding strategy. If herds increase beef sire use or lower cull rates over time, the share of income from calves could be even larger.

Based on CME feeder cattle futures as of October 15, 2025, beef income on our representative dairy is projected above $4.50/cwt over the next year, with seven of the next twelve months recording over $5.00/cwt. That is a substantial return directly benefiting dairy farmers. On top of that, producers can use price insurance tools like LRP to protect against beef prices falling below these levels, securing revenue at record highs.

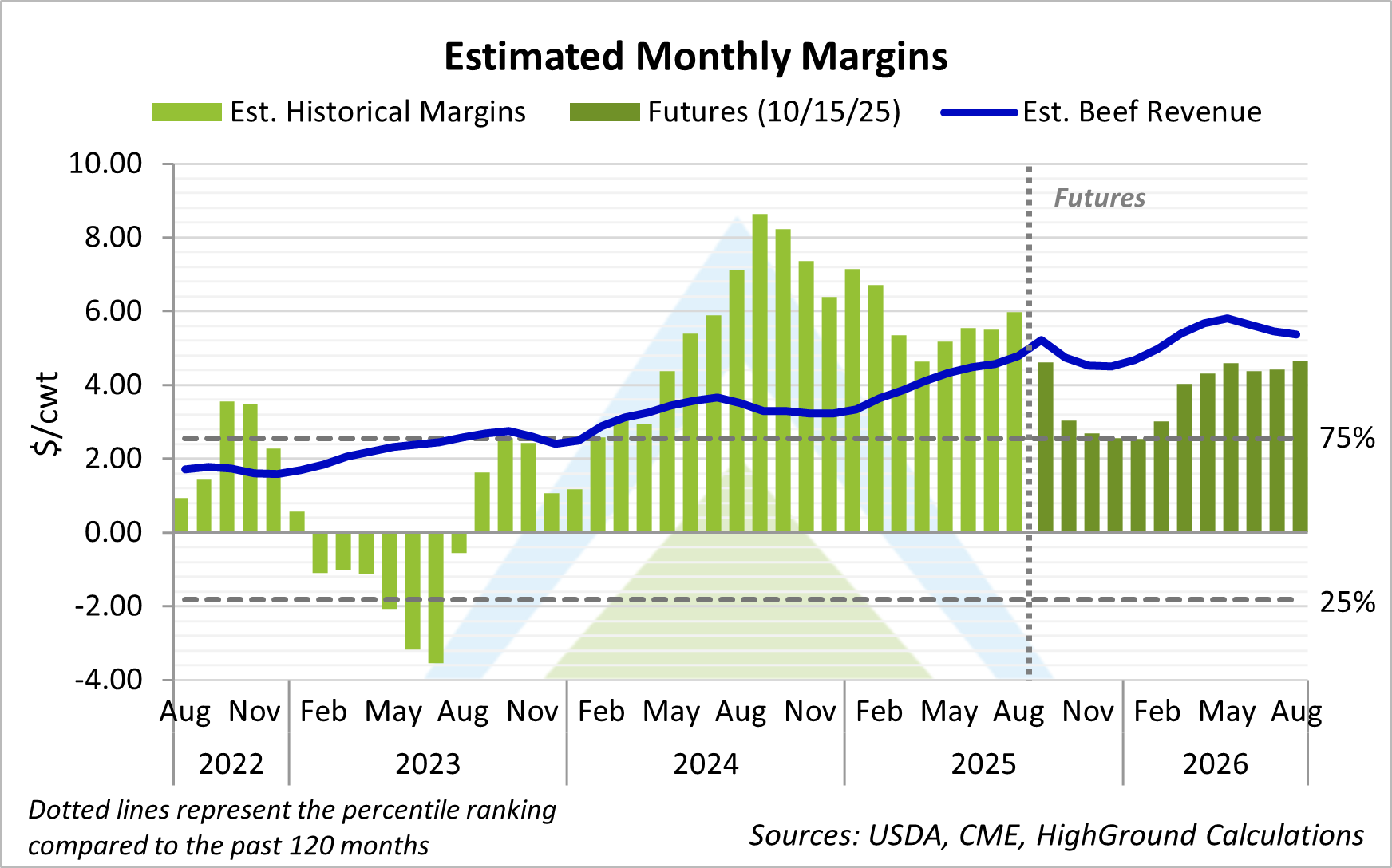

Looking forward, margins are looking quite favorable when considering dynamic beef values. Assuming a flat milk check adjustment of –$1.30/cwt and non-feed costs of –$8.00/cwt, current projections suggest strong profitability over the next year, with margins ranking above the 74th percentile relative to the past decade. Even as milk prices have softened since early 2025, elevated beef income and lower feed costs are helping offset the hit to milk revenue.

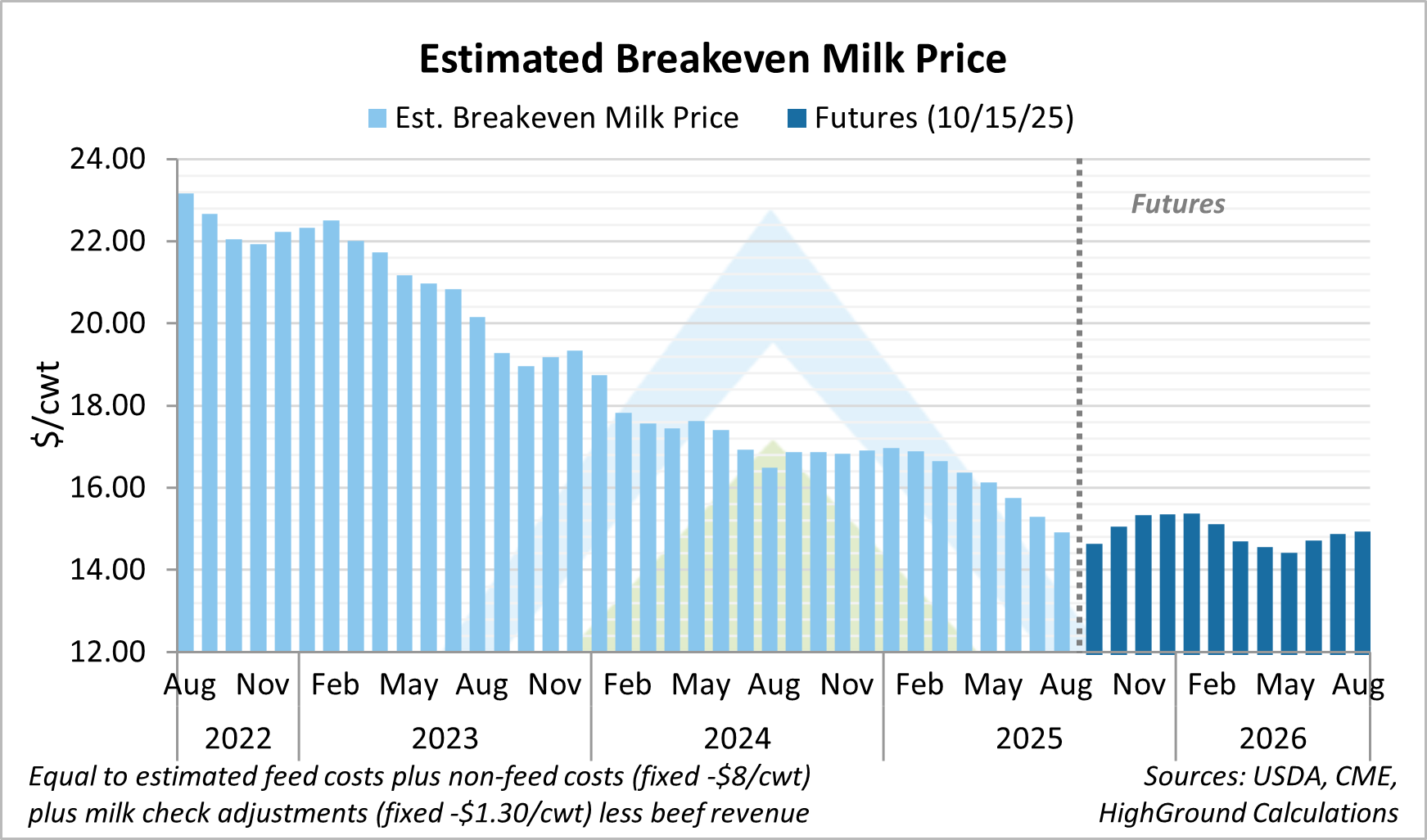

While margins seem to be great based on this analysis, at what point will milk prices get low enough that we see signs of struggle? The chart below depicts the breaking point for milk price using our dynamic model. According to our model as of October 15, milk prices would likely need to fall below $15.50/cwt over the next twelve months (specifically, between $14.42 and $15.38/cwt) to apply meaningful financial pressure at the farm level. In other words, a $15.50/cwt milk price could trigger early signs of contraction in milk production as producers shift to capitalize on high slaughter or replacement cow values. At 4.3% butterfat and 3.35% protein (average component levels from September 2024 through August 2025), a $15.50 all-milk price equates to roughly a $14.70/cwt Class III price ($15.30/cwt starting in December) and a $12.40/cwt Class IV price ($12.60/cwt starting in December). For comparison, October 15, 2025, futures prices for October milk were trading at $16.86 for Class III and $14.22 for Class IV, proving that the market is still a comfortable margin above our modeled breakeven range. However, milk markets are highly volatile, and if cooperative or processor programs begin reducing the incentive to produce higher component levels, particularly butterfat, that could also pressure milk checks further, even without major shifts in dairy product prices.

Of course, not all producers will experience these conditions equally. Management style, region of the country, and marketing programs all create variation in realized returns. For example, some cooperatives and processors have begun introducing base programs or market adjustments that limit milk payments, potentially reducing farm-level income below the all-milk price. These types of programs are not considered in our model’s milk check adjustment rate and could quickly shift the overall profitability of a farm. Additionally, operations without beef-on-dairy programs will not capture the same level of benefit, as Holstein bull calf values remain comparatively lower. Continued profitability will depend on sustained beef demand and price strength in the months ahead.

Even with those caveats, beef revenue has become a crucial component of dairy farm profitability in 2025. Strong cattle markets and lower feed costs are offering producers meaningful relief amid weaker milk prices. While the dairy industry has long balanced multiple revenue streams, the current market underscores just how important beef has become to keep operations profitable and resilient amid a market flush with milk.

While the objective of our model is to evaluate the impact that beef revenue has on the overall profitability of US dairy farms, we understand that every farm has unique circumstances that may make their situation look very different from what we have modeled for. If you feel that your farm’s numbers are not properly represented in this and would like to get a clearer view of the beef revenue impact on your farm, as well as the strategies available to mitigate the price risk associated with it, get in touch with one of our advisors today by emailing info@highgrounddairy.com.