Tuesday Morning Huddle

February 21, 2023

Bearish Sentiments Continues in US:

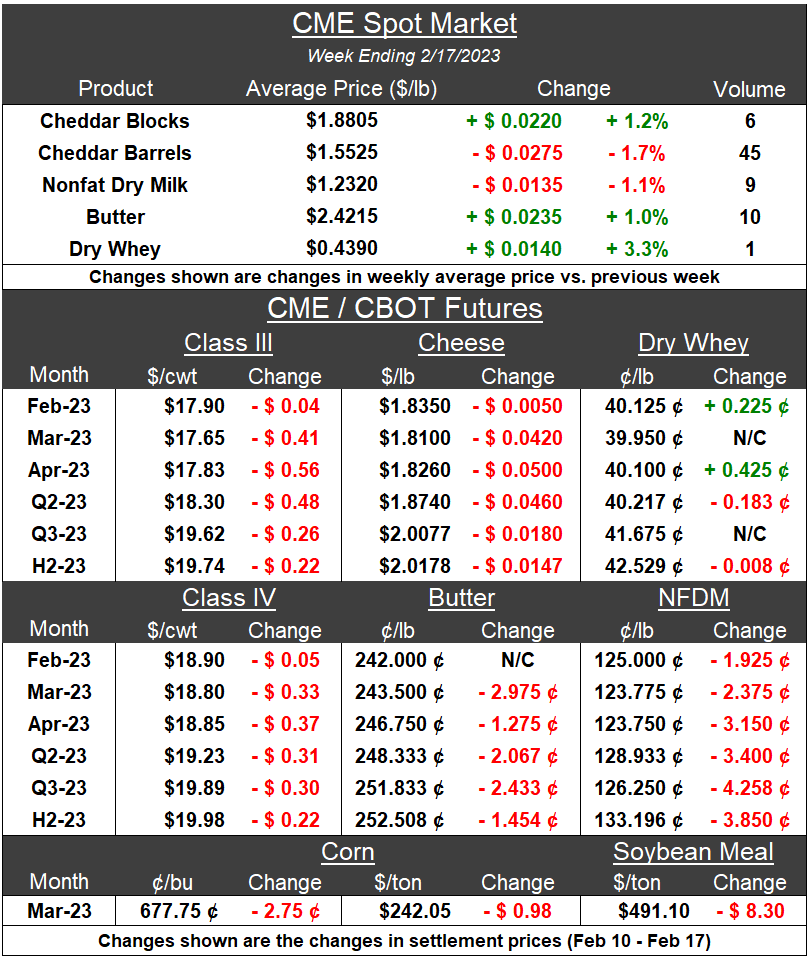

Spot markets were mixed at the CME last week, with barrels seeing 2023 lows before ticking back above to close out the week, NFDM also rolling back after a two week rally and while the weekly spot butter average increased by 1%, Friday’s CME settled fell to its lowest price ($2.3750/lb) since early February. Just six loads of Cheddar blocks traded last week, with low volumes the norm as of late and eked out a nearly $0.03/lb gain vs. the week before. Whey remains the star at CME, with Friday’s spot settlement ($0.45/lb) at its highest level since early December 2022! The lack of volume traded at the CME on both dry whey and Block Cheddar makes us doubt that their recent rallies have much more upside.

Milk supplies remain firm across the U.S., and contacts share that components (fat/protein) are more robust than usual for this time of year, which provides bearish undertones to the market as product production yields are higher. A late winter storm will create blizzard conditions for much of the Upper Plains and Midwest States this week which could test those robust yields, but likely just a short-term issue with temperatures expected to rise this weekend and next week.

On the other hand, dairy cow slaughter continues to track ahead of 2022, with over 65,000 head sent to packing plants the week of February 4, UP 4.5% vs. the same week in 2022. Year-to-date, 338,600 dairy cows have been slaughtered, an almost 8% increase against 2022, a sign that the supply-side infrastructure in the U.S. is not healthy.

International indices found support, but likely Short-lived:

Gulfood to provide new direction?

On the international front, Cyclone Gabrielle impacted dairy producers in New Zealand with heavy rains affecting crops and pastures on portions of the North Island. Today’s GDT auction will provide another opportunity for Asia/Middle East buyers to voice sentiment regarding the impact of this weather event.

In Europe, weekly dairy indices rose, but that trend may be short-lived with recent milk production data suggesting early 2023 will be stronger than 2022, and seasonal growth into the spring peak will provide abundant milk supplies against a flat demand outlook.

The Middle East’s largest food show, Gulfood, is taking place this week in Dubai and many international buyers, sellers and traders are in attendance. Shows like this tend to create trading activity during or shortly thereafter based on sentiment so we look forward to hearing back from our clients and colleagues at the show this week.

Last Week’s Reports & Analysis

December 2022 US Dairy Supply and Utilization

Total cheese utilization saw further advancement over the previous year in December supported by strong commercial exports and a return to year-on-year growth… Full Report

December & Q4 2022 EU-27 + UK Dairy Export Volume Analysis

It was a tough year for EU dairy exports, primarily due to low supplies for much of the season that dragged export volumes to the lowest annual level since 2019. Total dairy shipments to China fell to…Full Report

Reports This Week

- Global Dairy Trade Auction – Tuesday, February 21

- Dec 23′ EU-27 + UK Dairy/Milk Production Analysis – Tuesday, February 21

- Jan ’23 New Zealand Export Data – Wednesday, February 22

- Jan ’23 China Import Data – Wednesday, February 22

- Weekly EU Dairy Commodity Prices – Wednesday, February 22

- Jan ’23 US Milk Production Report – Wednesday, February 22

- Weekly National Dairy Products Sales Report (NDPSR) – Wednesday, February 22

- USDA Dairy Market News Weekly Midpoint Prices – Thursday, February 23

- USDA Weekly Dairy Cow Slaughter – Thursday, February 23

- Jan ’23 US Cold Storage Report – Friday, February 24