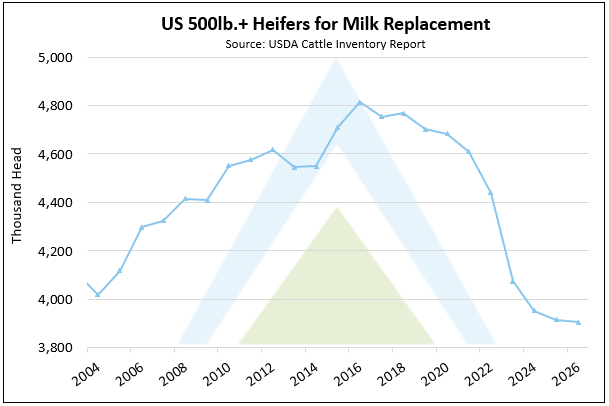

Although US heifer inventories are at almost 50-year lows, US dairy cows are at their highest level in over 30 years. From June 2024 to September 2025, at the milking herd’s latest peak of 9.579 million, US dairy farmers added 258,000 head, driven by low slaughter rates despite small replacement numbers. The latest reading of US cow numbers from the USDA’s Cattle Inventory Report showed 9.568 million head of dairy cows, a 2% gain (+187,500) from the 2024 survey. However, the total number of dairy heifers stood at 3.905 million head as of January 1, 2026, a figure that has declined for the past eight years and is at its lowest level since 1978. In addition, the heifer-to-cow ratio sits at just 0.41, its lowest value since 1990, when the herd was a half-million head larger and in a period of contraction. Heifers expected to calve fell to 2.9498 million head, the lowest value in the dataset since 2002.

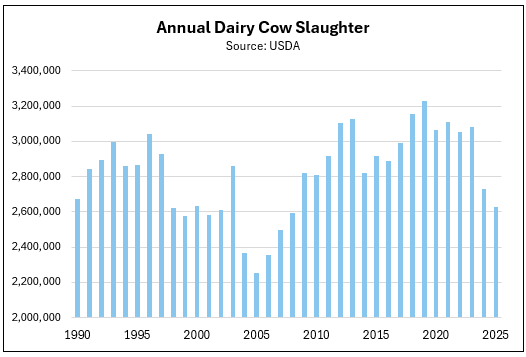

In 2025, weekly slaughter data showed that 2.626 million dairy cows were sent to packing plants, the lowest annual total since 2008. Coupled with 2024’s very weak figure of 2.726 million head, US dairy has notched two years of depressed culling. Looking at the percentage of the herd slaughtered in those years shows that these rates are declining. Cull rates fell below 30% in 2024 after remaining above that level from 2009 to 2023. The last time the herd was building over a multi-year period, from 2004 to 2009, cull rates were also below 30%, meaning the dip is not surprising and indicates farmers are hanging onto older cows.

However, heifer numbers from 2004 to 2009 were at healthier levels and trended upward, supporting US herd growth. That is not the case in 2026 and at some point, these older cows will be culled. The ongoing low heifer-replacement story has the potential to create a bottleneck and a supply pinch in the future. This is especially true when one considers that it takes at least two years for a calf to grow into a milk cow, meaning that if the problem is realized, it could persist for some time.

Adding to these dynamics are near-record-high cattle prices and strong demand for beef due to a small beef herd. From the supply side, US beef cows are at their lowest level since 1961 and have declined year-over-year for the past seven years. Replacement numbers improved slightly, up 0.9% (+41,700 head), indicating the breeding herd is beginning to restock. However, that will take time, and with total heifers numbering just 4.714 million head, a historically low figure, this will limit the speed of expansion.

Additional headwinds are blowing as well. Last year’s calf crop of just under 32.9 million head was the smallest in the dataset since 1977. Heifers, steers, and cattle on feed – which are the animals that will be used for processing – declined year over year, highlighting that supplies will remain tight in the sector.

These tight supply dynamics pushed cattle prices to record highs in October 2025, and they are currently trading near those levels. Strong feeder cattle prices have been one of the driving forces behind dairy farmers’ decision to hang on to cows. Producers have shifted to breeding more of their herd for beef genetics, producing valuable crossbred calves. Reducing herd size means fewer calves and a smaller revenue stream. Between cull cow and crossbred calf sales, HighGround’s model estimates that this revenue stream added, on average, $4.37/cwt. to a farmer’s income in 2025, keeping profitability healthy.

Until on-farm dairy margins move into the red for a sustained period—six months or more—dairies are likely to keep cow numbers lofty, provided there are no reproductive issues. At some point, likely within the next couple of years, older cows will need to be culled, particularly when reproduction becomes an issue, and they are no longer able to produce a crossbred calf to boost revenue. Given tight heifer supplies, i.e., limited replacements, this could slow milk volumes and support milk prices.