Launching oneself headfirst into China can only be the best way to rapidly learn about this often-misunderstood market. While Wuhan has received some flak over the last five years, lambasted as the birthplace of the most recent global pandemic, it is also the capital of the Hubei province, and the home to 11 million people. Notably for this author, the ever-correct Wikipedia denotes Wuhan as the “Chicago of China” – due to its role as a major transportation hub within central China. So, with that preface in place, attending the annual China Bakery Autumn Expo held in the impressive Wuhan International Expo Centre is a great place to peek into the world of the bakery industry in China, covering both this rapidly growing section of dairy product use and a dynamic part of the ever-changing consumerism taking place in China.

The expo covers one half of the Wuhan International Expo Centre and this year, 100,000 people attended over the three days. Attendees ranged from consumers wanting to try the freebies and latest product development through to bakers chasing the best list of ingredients for their operations ahead of the coming Chinese New Year. The expo also offered manufacturing and processing assets, both manual, automated and robotic in form. In another section, packaging solutions were on offer, including the cryogenic freezing technology that is allowing for streamlined bakery operations in cafes around China. The expo covered everything and anything that the bakery industry needed, and the range and quality on offer were impressive.

Bakery products are something that I pride myself on testing – New Zealand has a great bakery scene, with savory meat pies and custard squares pivotal in the Kiwi psyche. Having also travelled through Europe a few times, I am also a seasoned tester of French bakery classics; I know my way around a croissant or a pan au chocolat and everything else offered in a French bakery for that matter! So, I find that I had high expectations for what I considered high-quality bakery products heading into the China Bakery Expo on that Saturday morning; interestingly enough, those expectations were well and truly met within the first five minutes inside the Expo Hall.

Across the entire expo, there were countless display cases filled with beautifully presented baked goods, from artisanal bread loaves through to intricate pastries, croissants were offered with both savory and sweet fillings, along with decadently decorated cakes, slices and every other format of sweet treat possible. Alongside classic French bakery fare were Chinese-developed baked goods – loaves of “cheese garlic sticks,” for example, with an ingredient list boasting the ratio of cheese, butter and cream used within the recipe, notably all Fonterra’s Anchor Food Professional products. The inclusion of Chinese flavors within baked goods was also obvious, chestnut-flavored cupcakes, taro puffed pastry and bean paste buns for example. Egg tarts were a very common product offered across many display cases and tasting events, and their popularity amongst attendees was impressive and understandable considering how good they are!

Talking to people on stands at the event, bread consumption was a notable change happening in China. Traditionally, non-sweet and chewy French breads, such as baguette or sourdough, are not historically desired in China; however, as bakeries expand their repertoire to keep up with the growing desire for more decadent products, consumption of these French-style breads is growing. As a result, cheese usage is also increasing alongside the growth of these bread types – the European style of sandwiches is also growing, although again, with a Chinese twist.

Overall, the quality and style of bakery goods on offer and displayed at this event were impressive – the trend of coffee and cake as an infrequent treat within tier 1 and tier 2 cities is a large part of current urban culture in China. Something that was reinforced in Shanghai, where display cases carried the same products on show in Wuhan.

Let’s Talk Ingredients

Every baker knows their unsalted butter from lactic butter – it is a paramount product in a world-class pastry product. Again, one of the goals of attending the Wuhan Bakery Expo was to understand how much butter was being used in this format, and what the competition for butter supply looked like. From the New Zealand perspective, China has steadily grown its butter import demand over the last ten years, with Kiwi product accounting for the bulk of the imports. While butter is not a traditionally consumed product in Chinese cuisine, the influx of Western-inspired foods is rapidly changing that trend, especially via bakery items.

A trend of the Chinese dairy industry over the last three years has been the increase in cream separation and utilization in both butter and other cream applications. At the expo, there were many local processors offering “82%” butter options, or “100% milkfat butter,” along with a few other dynamic options. After discussing these offerings with someone in the local foodservice industry, they explained that not all of the options showcased were completely butter, often a butter-vegetable oil mix, etc. Notably, the foodservice professional did mention that these products are improving in quality quickly and are appearing more and more across the Chinese markets, competing with imported butter products.

Alongside butter products, including a lot of butter sheets, whipping cream products were the most advertised, somewhat as the fresh product on most stands – all UHT products, in 1 liter Tetrapak bottles. Interestingly, all the packaging looked wildly similar to Fonterra’s whipped cream products… imitation is the highest form of flattery, I suppose. Looking past the branding, the product specs were variable, from milkfat percentages, vegetable oil inclusions, right through to the flavor, such as “cheese flavor.” Again, the imitation only goes as far as the packaging, with the functionality of the whipping cream on offer not to the same spec as the Fonterra team has achieved, helping to keep the kiwi product in the premium arena, for the time being. The pace of development of these products by all Chinese processors suggests that the functionality hurdle will be quickly leapt.

Another important avenue of cream consumption was via other recipe requirements – cream cheese, mascarpone and egg tart cream – with the latter being offered as a “ready to use” item; pour into a case and bake. Cream cheese was also offered in multiple formats – in the silky smooth format on top of tea to make the cream cheese tea macchiato, and the firmer spreadable or mixable format. Tiramisu is a big thing in China – it was mentioned multiple times across the entire trip – a driving force for mascarpone demand currently, and likely into the future as this key Italian-style cream cheese gains popularity within Chinese demand for decadence. Something mirrored by importers’ strategy for the future of cream imports – whipped cream, cream cheese and mascarpone products are likely to keep growing.

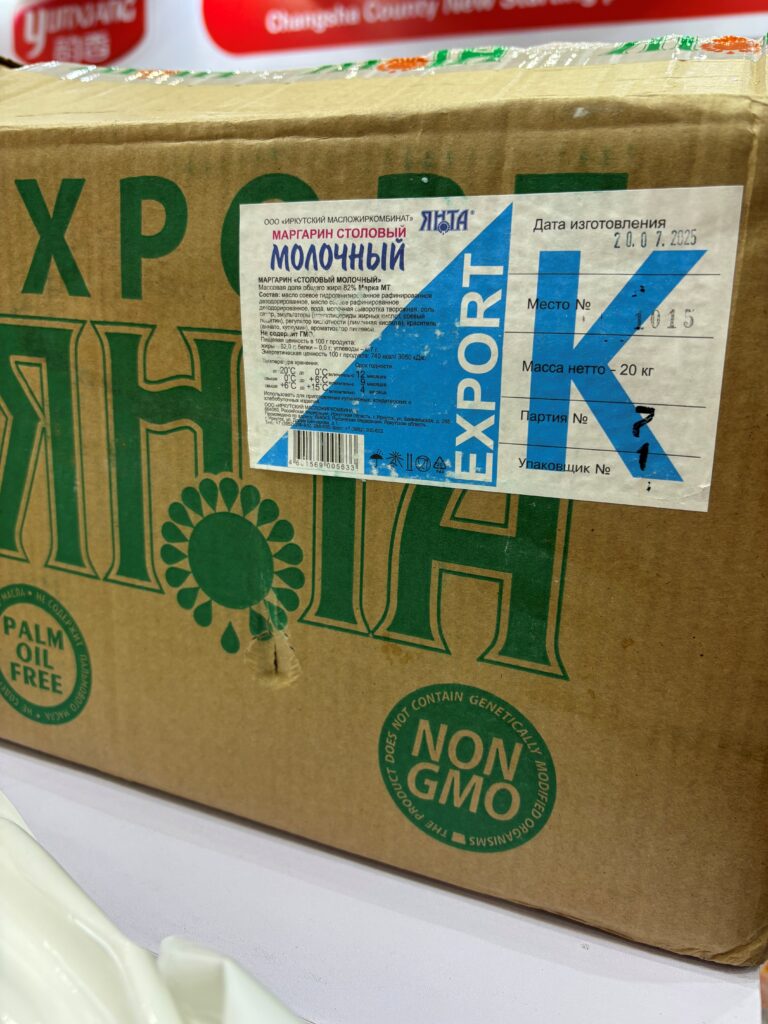

Where product was produced at the expo was also a key interest – I had a preconceived expectation that NZ product would be the most commonly advertised origin of imported products – an idea that was rapidly destroyed after only finding two mentions of kiwi products at the entire show. “China Made” was the big surprise, with the local origin proudly on show across many stalls and products, confirming the change recorded in other consumer products. Another surprising find was Russian butter on offer from a local trader – when asked about access and quality, I was promptly told it was “top quality” and they had a plentiful supply. After a bit of digging, it was confirmed that some products included imported milk solids, but that was no longer deemed an important product differentiator for the marketing team…

Alongside the headline-worthy cream cheese tea macchiato, Chinese coffee culture is at an impressive level, which is another key avenue of dairy consumption to be aware of. The lattes and flat whites, in both hot and iced formats, were impressive to say the least. Imported and domestic UHT fluid milk was also frequently advertised at the expo alongside fresh milk products.

Cheese products were also advertised, from Cheddar slices through to shredded Mozzarella. Most of the cheese on offer was in domestic packaging, Panda Brand and Milkground, while the origin of production was somewhat unclear. While there were multiple displays of cheese products, they were not as strongly promoted as the cream or butter products, although cheese was strongly included in recipes, mostly on bread products.

Takeaways

The expo answered many questions for me – the quality of products is impressive, world-class. Cream consumption will continue to grow in China, with the current level much lower than that of the Western world. Growth of cream consumption is likely limited by the speed at which consumers are willing to keep up with the development of bakery goods, especially those with a Chinese twist, and then the associated affordability of these products, with the latter likely the largest drag on the rate of consumption growth. “China Made” is indeed the trend currently, quality and trust of domestic product have changed rapidly since the early 2000s, when domestic quality was much lower, and trust was even worse – this is an important factor for the shape of future dairy import flows. There is little doubt that Chinese quality is impressing the local population, and the growth of cream and cheese consumption and production in China will continue at an impressive rate.